GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

Bookkeeping is not just a backend task; it is the financial backbone that holds your entire operation together for businesses. And when it comes to managing this critical function, business owners are often faced with a tough decision whether to choose outsourced or in-house bookkeeping.

Do you build an internal team that handles everything under your roof, or do you partner with an outsourced bookkeeping provider who brings industry expertise, tech tools, and compliance know-how, often at a fraction of the cost?

This blog guides you through the pros, cons, costs, and key decision-making factors when choosing between in-house accounting staff and outsourced providers. Whether you're just starting out or scaling up, we'll help you understand the benefits of outsourcing bookkeeping, the risks involved, and how to evaluate all available bookkeeping options for SMEs.

Understanding the basic difference between these two models is the first step to choosing the right bookkeeping solution for your business. Let’s unpack it.

In-house bookkeeping refers to hiring an employee or team within your organisation to manage all aspects of your financial records, invoice tracking, bank reconciliations, BAS lodgements, payroll, compliance reporting, and more. It gives you physical control and proximity, but with that comes added costs, responsibilities, and risk.

Outsourced bookkeeping, on the other hand, involves engaging an external agency or virtual bookkeeper to handle the same tasks, only remotely. In most cases, you get access to a team of experts who use cloud platforms like Xero and QuickBooks, stay up to date with Australian finance regulations, and handle everything from payroll to BAS management, allowing you to focus on running your business.

So, is outsourced bookkeeping better than in-house? It depends on your size, industry, growth plans, and how hands-on you want to be with your finances. But for many Australian SMEs, outsourcing is proving to be a cost-effective bookkeeping strategy that balances flexibility with professional accuracy.

When your bookkeeper is in the same office, communication is immediate. Need to review last month’s BAS figures? This immediacy can be beneficial for businesses with complex cash flows or fast-paced daily operations that require constant financial input.

Some business owners prefer keeping sensitive financial information in-house. They like the idea of having complete control, being able to see how and when data is managed, which reduces the perceived risks of handing information over to a third party.

In-house accounting staff can work closely with sales, operations, and admin teams to align budgets, monitor expenses, and support day-to-day decision-making.

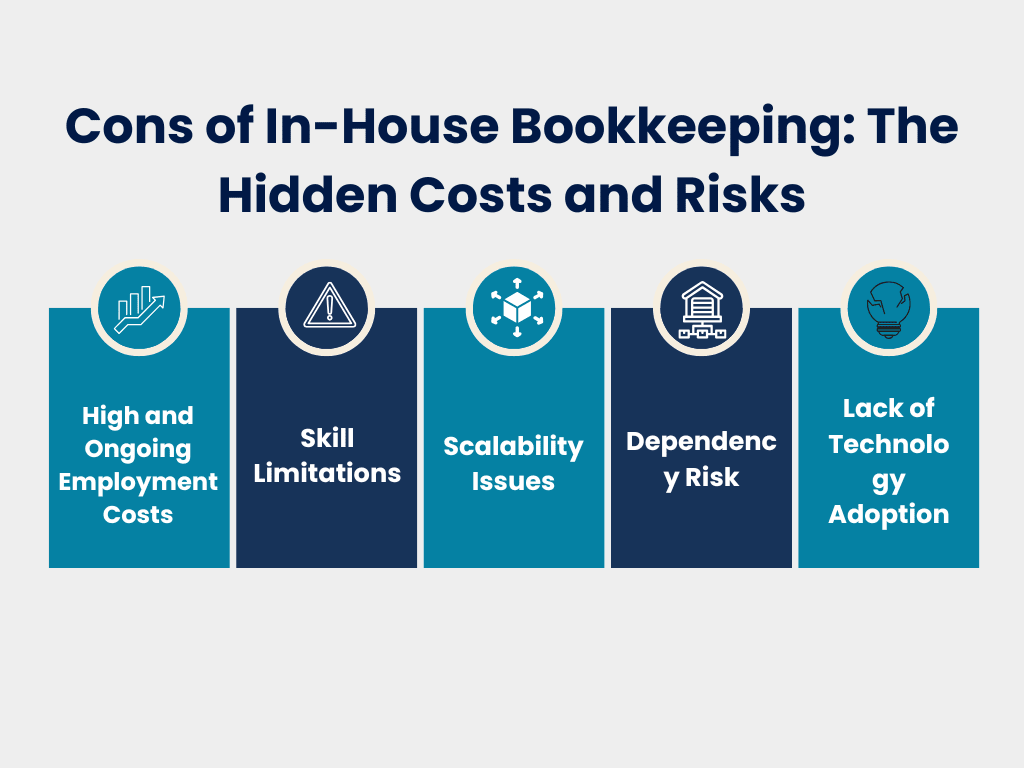

Hiring in-house isn’t cheap, salaries for bookkeepers in Australia average between $55,000 $80,000 annually. For a small business, this is a significant financial burden, especially if your accounting needs fluctuate throughout the year.

In-house bookkeepers may be strong in one area but lack depth in others. For example, your internal team member might be fantastic with reconciliations but struggle with BAS lodgments, payroll compliance, or interpreting the latest Australian Taxation Office (ATO) rules.

Your in-house staff can handle the books when you're small. But what happens when you grow? When does your transaction volume triple? When you expand into international markets? Scaling in-house means recruiting, onboarding, and managing more staff, which pulls time and resources away from your core business.

If your one and only bookkeeper falls sick, goes on leave, or resigns, who steps in? The risk of disruption is real. Many SMEs face urgent financial bottlenecks simply because their bookkeeper is away for a week.

Even though the industry has been modernised by cloud tools like Xero, QuickBooks, and MYOB, not all in-house hires stay up to date with the newest technological advancements. Slower procedures, inconsistent reporting, and lost automation opportunities that could have saved you time and money are all possible outcomes of this.

In Australia, small and medium-sized companies are re-examining how to handle financial processing. The time when the reliable role could only be played by the in-house bookkeeper is long gone.

Many businesses are increasingly using outsourced bookkeeping services as a more efficient and cost-effective way to ensure financial accuracy, compliance, and agility, without incurring significant budget dollars.

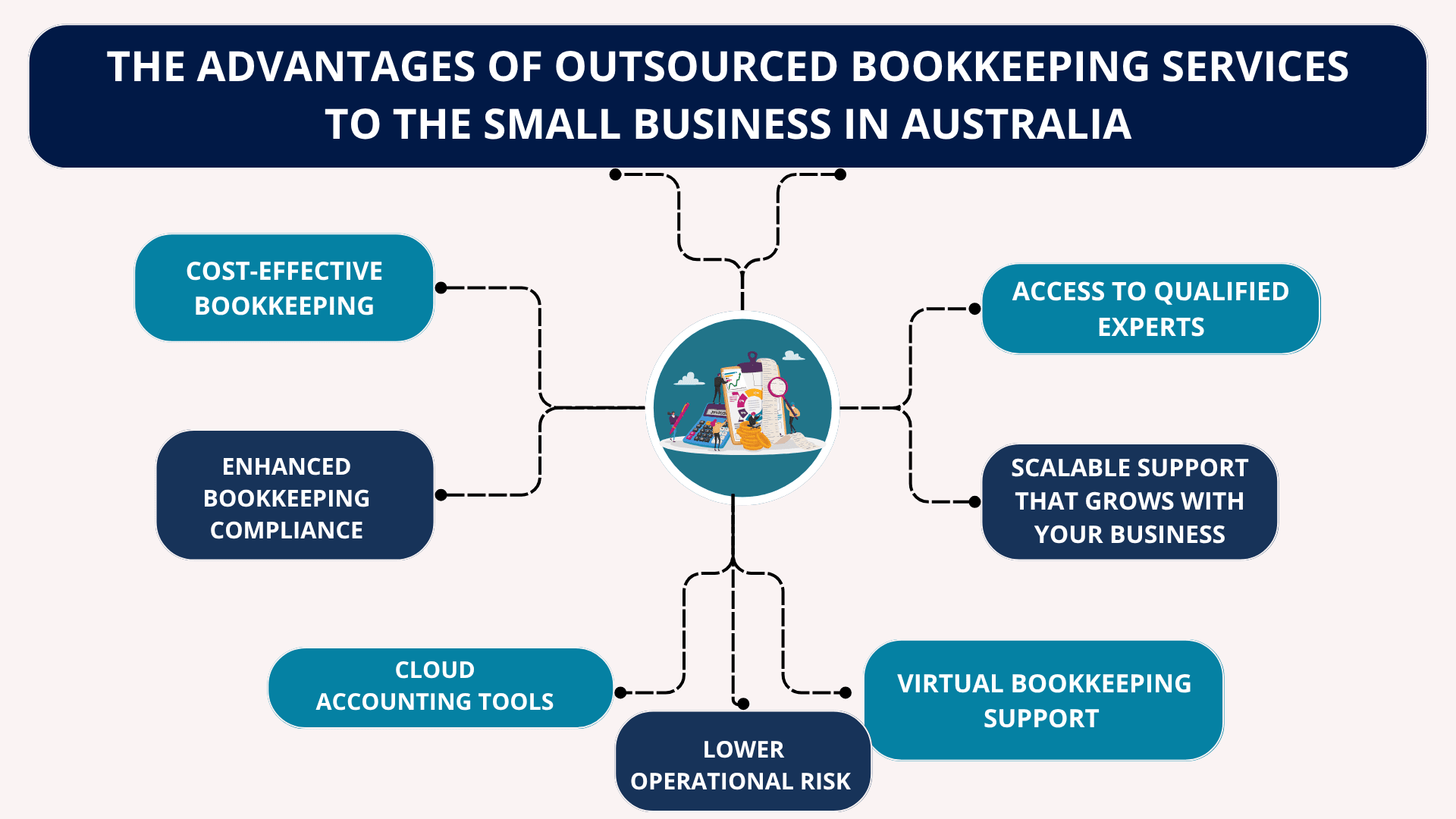

One of the biggest advantage of outsourcing is the cost savings. Compared to the all-in expense of hiring an internal bookkeeper (salary, superannuation, software, leave, training, and office space), outsourcing offers a lean and flexible pricing structure.

With cost-effective bookkeeping packages starting as low as $300–$500 per month, businesses gain access to professional services without overcommitting their finances. This pricing model also makes it easier to compare bookkeeping costs in Australia and find the right fit without getting locked into long-term contracts or overhead-heavy commitments.

|

Pro Tip: If you’re calculating what’s cheaper: in-house or outsourced bookkeeping?—run the numbers including all on-costs like super and training. Outsourcing often wins by a significant margin, especially for SMEs. |

You only get one set of skills when you hire someone internally. You can access a group of experts with specialised knowledge when you outsource.

Do you need assistance with ATO and BAS compliance? Do you want precise cash flow forecasting or payroll processing? You can access professionals who are knowledgeable, up-to-date, and frequently certified in their fields by using outsourcing services.

This becomes especially valuable for SMEs that:

Don't have the budget to hire multiple roles internally.

Need advice on Australian finance regulations, tax efficiency, and ATO updates.

Use platforms like Xero and QuickBooks, and want someone experienced in integrating them with CRMs or payment systems.

Outsourcing firms are also more likely to stay current with changing legislation and accounting best practices, so your books stay compliant, accurate, and audit-ready all year round.

|

Pro Tip: Tired of hiring one person to juggle payroll, invoicing, reporting, and compliance? Outsourced bookkeeping services give you multi-skilled coverage, without any hiring process. |

We all know that, staying compliant with the ATO is no easy feat. From Single Touch Payroll (STP) and superannuation lodgment to Business Activity Statements (BAS) and fringe benefits tax (FBT), there’s always something new around the corner.

When you outsource, you’re not just hiring a number-cruncher, you aree gaining access to a provider that lives and breathes bookkeeping compliance with ATO.

Many outsourced providers are registered BAS agents, meaning they are legally authorised to lodge statements, correct errors, and represent your business to the ATO. That kind of compliance protection is something most in-house staff can’t provide without extra training and certification.

|

Pro Tip: Worried about penalties, late lodgments, or missed GST credits? Let a registered BAS agent handle your compliance while you focus on running the business. |

One of the most underrated advantages of outsourced bookkeeping is scalability. Whether your business is seasonal, experiencing rapid growth, or running multiple projects at once, outsourced teams can scale up or down without missing any detail.

Need help with payroll and BAS management during tax season? Need to add financial reporting for investors? An outsourced provider can simply increase your service hours or expand the scope no recruitment, no restructuring.

This is a game-changer for bookkeeping services for Australian businesses that don’t want to be trapped by rigid internal staffing limitations.

|

Pro Tip: Choose a provider that offers custom packages. A scalable bookkeeping solution will adapt to your business not the other way around. |

Outsourced providers typically operate in the cloud and that’s a good thing. If you're still emailing spreadsheets back and forth or using desktop-based software, you're falling behind.

Modern outsourced bookkeeping services rely on platforms like:

Xero

QuickBooks Online

Dext (for receipt management)

Hubdoc (for automated document capture)

These tools don’t just increase productivity, they ensure real-time access, automatic bank feeds, and collaborative bookkeeping where both you and your provider can see and act on the same numbers.

Plus, they come with bank-grade security, ensuring your financial data is safe and compliant with data security in outsourced accounting protocols.

Pro Tip: Ask your provider to set up dashboards so you can check cash flow, profit, and pending bills from your phone, anytime, anywhere.

Managing operations across multiple cities or even time zones? No problem. One of the most powerful features of outsourcing is virtual bookkeeping support.

With a cloud-based provider:

You can access reports from any device, 24/7.

You can schedule Zoom check-ins or request updates without being tied to geography.

Your books stay updated regardless of where your team or office is located.

In 2025, when hybrid and remote work are the norm, virtual bookkeeping is no longer a compromise, it’s a competitive advantage.

|

Pro Tip: Even if your provider isn’t based in your city, make sure they have experience with Australian finance regulations and ATO reporting standards to ensure local compliance. |

What happens if your in-house bookkeeper goes on leave? Or resigns suddenly? The risk of downtime or even financial disarray is very real.

By contrast, outsourcing firms have teams and systems in place to ensure zero disruption. If one team member is away, another steps in. This reduces your operational risk and improves business continuity, ensuring that your financial tasks are handled consistently, even during unexpected incidents.

|

Pro Tip: Always ask about a provider’s continuity plan. A great company will offer a dedicated contact, backup support, and a structured system. |

Choosing between outsourced vs. in-house bookkeeping is a important decision for any small businessees. While in-house accounting offers direct control, it has high costs and HR challenges. On the flip side, outsourced bookkeeping services for Australian businesses provide cost-effective, expert-led support with flexible pricing and access to the latest tools like Xero and QuickBooks.

With growing compliance demands from the ATO and the need for payroll and BAS management, many SMEs are finding that outsourcing offers better value, stronger data security, and fewer headaches. So if you're comparing bookkeeping options for SMEs, outsourcing might just be the smarter, more scalable solution in 2025.

At Aone Outsourcing Solutions, we help small businesses and accounting firms simplify their finances with affordable, accurate, and compliant bookkeeping services. Whether you need full-time support or flexible virtual bookkeeping for payroll, BAS, and ATO compliance, our experienced team delivers results that save you time and money.

We work with leading tools like Xero and QuickBooks, follow strict data security measures, and ensure every transaction meets Australian finance regulations. With us, you get the best of both worlds, the expertise of an outsourced provider and the personalised care of an in-house team, without the high overheads.

Yes. Outsourced bookkeeping in most of the SMEs in Australia is cheaper than employing in-house personnel. It saves on costs such as salaries, superannuation, software subscriptions, and training providing a pay-as-you-go option.

The outsourcing of the services of bookkeeping in most cases is cheaper since there are fewer overheads. The exact comparison however, will depend on size, complexity and volume of transaction in the business.

Yes. In Australia, professional outsourced bookkeepers can use Xero, QuickBooks, MYOB, and so on, and all their data can be transferred with smooth work processes.

Creating a plan and taking into consideration the cost, experience necessary, scalability, compliance requirements and security of the data. SMEs tend to outsource because they are more flexible whereas bigger entities are inclined to keep control in-house.

In the case of the majority of SMEs, yes. Outsourcing becomes more advantageous in 2025 especially in regard to achieving value, increased precision, and flexibility with increased wages, increased ATO compliance requirements and technical advancements associated with cloud technology.

At Aone Outsourcing Solutions, we believe smart businesses don’t just manage their accounting; they streamline their accounting process. With years of experience supporting accounting firms and businesses across the UK, USA, Canada, Australia, and Ireland, our team knows how to turn everyday financial processes into strategic advantages.

From bookkeeping and payroll to tax preparation, accounts payable, and compliance, weve helped firms simplify their accounting workflows, cut operational costs, and maintain complete accuracy at every step.

Because at Aone, your accounting success is the goal we care about most.

Content on this website is shared for general awareness and educational purposes only. It should not be taken as financial, accounting, taxation, or legal advice. At Aone Outsourcing Solutions, we do our best to keep all information relevant and accurate; however, we can’t promise that every detail is up to date or fits every business situation. Because regulations and compliance requirements can change, we encourage you to seek guidance from an expert professional before acting on any information on this site. Aone Outsourcing Solutions will not be responsible for any decisions made or losses incurred based on the material published on this website. For advice specific to your business needs, please get in touch with our team .

Special characters are not allowed.