GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

In Australia, Business Activity Statement (BAS) lodgment deadlines for 2025 depend on your reporting cycle. Quarterly BAS is due on 28 October 2025, 28 February 2026, 28 April 2026, and 28 July 2026. Monthly BAS is due on the 21st of the following month. Annual BAS for the 2025–26 financial year is due by 31 October 2026 (or with your tax return). Extensions may apply if you lodge via a registered BAS or tax agent. (Source: ATO)

Operating a business in Australia requires the timely filing of Business Activity Statements and meeting other essential tax obligations. Staying updated with your BAS due dates 2025 is crucial, as missing deadlines can lead to substantial ATO penalties, affect your cash flow, and impact your overall tax compliance. Incorrect deadline compliance will lead to substantial fines that disturb your income flow and your Australian Taxation Office (ATO) state of adherence.

The due dates for the BAS 2025-2026 financial year, which differentiate between quarterly and monthly reporters, ensure your administrative and financial peace of mind. This complete guide explains all necessary information about lodgment cycles and payment methods, enabling you to focus on business expansion while maintaining ATO tax compliance.

Missing BAS statement due dates can make you pay fines from the Australian Taxation Office (ATO) and you can miss opportunities to claim deductions. By managing your BAS statement, you get smooth business operations and avoid last-minute scrambles. Keeping your financial records updated and structured also enables you to forecast cash flow effectively, so that your business can remain financially stable throughout the year.

BAS refers to the abbreviation for Business Activity Statement, which acts as the ATO reporting framework.

Businesses using a Business Activity Statement (BAS) due date must provide tax reports to the ATO which include payments of Goods and Services Tax and Pay As You Go (PAYG) instalments together with PAYG withholding tax and other applicable taxes like luxury car tax and fuel tax credits, and wine equalisation tax.

Goods and Services Tax: This consumption tax is applied to most of the goods and services in Australia, and businesses collect it on behalf of the government.

Pay-as-you-go (PAYG) instalments: are income tax prepayments that businesses and sole traders make yearly to reduce their end-of-year tax burden.

PAYG withholding tax: Businesses that employ staff must tax from employee wages and remit these amounts to the ATO regularly.

Lodging your BAS correctly and on time ensures that your business remains tax-compliant. The ATO uses the information in your BAS to assess your tax liabilities and ensure that you meet your financial obligations. If you're unsure about BAS lodgment, a registered BAS or tax agent can assist with your compliance obligations and help you navigate complex tax regulations.

Accurate and timely BAS lodgement keeps your business tax-compliant and prevents financial penalties. Tax agents who are registered to provide services help their clients prepare and submit Business Activity Statements.

Each year the reporting frequency of BAS depends on your GST turnover level. Your reporting requirements at the Australian Taxation Office take into account the size of your business and the extent of taxable income you earn.

Quarterly: Every quarter is the minimum reporting period for businesses that maintain annual GST turnover less than $20 million. The reporting frequency offers business owners a middle-ground since it suits regulatory needs and operational efficiency.

Monthly: Nearly every business that exceeds $20 million in annual GST turnover must submit their declarations to the ATO on a monthly basis. The ATO needs larger businesses to submit their tax reports frequently because they need to collect taxes accurately.

Annually: Businesses which voluntarily register for GST under $75,000 profit or $150,000 non-profit threshold can file reports annually. The simplified reporting method is compatible with companies with reduced transaction activity and who want easier documentation procedures.

Grab a One Month Free Trial & Be Updated On Latest BAS Due Dates & Submission!

Extensions apply when lodging through a registered tax or BAS agent. Working with an agent can provide additional time to file, reducing last-minute stress and allowing for proper review of financial data.

For businesses required to lodge monthly BAS, the deadline is the 21st of the following month:

2026 Monthly BAS Due Date

Businesses lodging an annual BAS for the 2025-26 financial year must submit it by 31 October 2026, unless lodging with a tax return, in which case the tax return due date applies. Annual reporting is beneficial for businesses with simpler financial structures, as it reduces compliance requirements and administrative workload.

You can lodge your BAS through several methods, each offering different levels of convenience:

ATO’s Online Services – The Business Portal, MyGov for sole traders, or Standard Business Reporting (SBR) enabled software make digital lodgment simple and efficient.

A registered BAS or tax agent – Tax professionals can handle your lodgment accurately and ensure compliance with tax laws.

By Mail – Although this option is possible, it is not as popular and takes longer to process, which can cause delays.

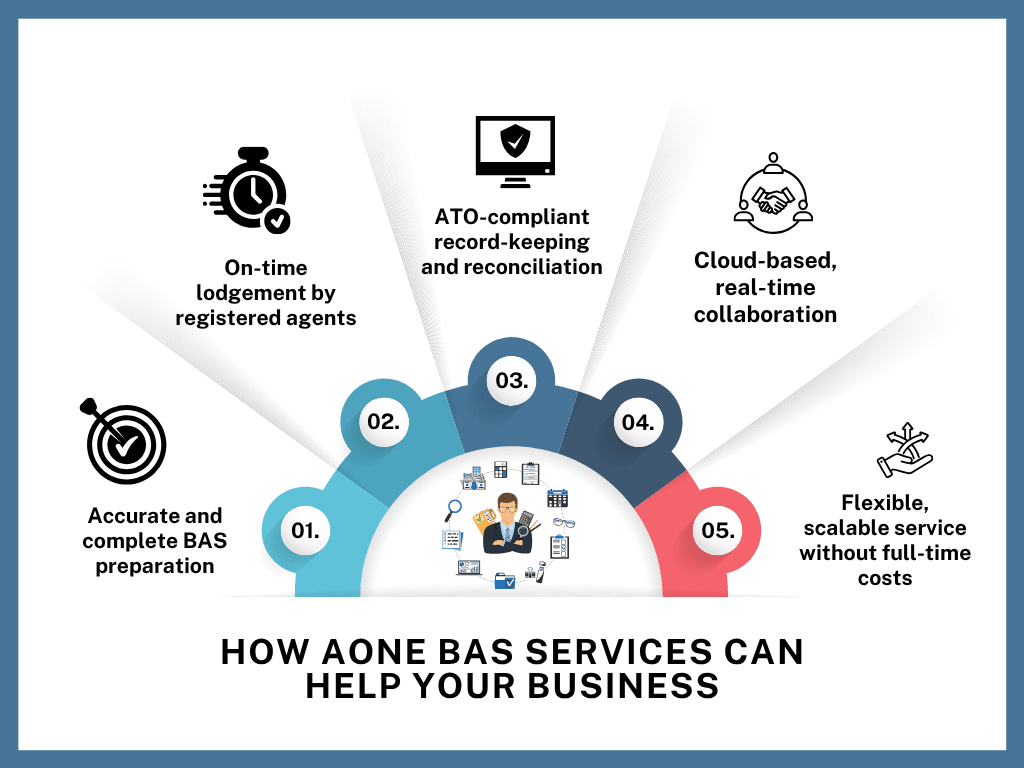

Managing Business Activity Statements (BAS) is more than just meeting deadlines, it’s about accurate reporting, avoiding penalties, and staying compliant with ATO regulations. At Aone Outsourcing Solutions, we simplify BAS with expert-led, cloud-powered support tailored to your business.

Here’s how Aone can assist you:

Accurate and complete BAS preparation: We ensure your GST, PAYG instalments, PAYG withholding, and other tax obligations are correctly calculated and reported every cycle.

On-time lodgement by registered agents: Our team lodges your BAS directly with the ATO, reducing the risk of penalties and allowing access to professional lodgement extensions.

ATO-compliant record-keeping and reconciliation: We reconcile your accounts with your accounting software and supporting documents to avoid errors or audit triggers.

Cloud-based, real-time collaboration: We work with platforms like Xero, QuickBooks, and MYOB to streamline workflows and provide live access to your BAS status.

Flexible, scalable service without full-time costs: Whether you lodge monthly, quarterly, or annually, our outsourcing model gives you expert service at a fraction of the cost of hiring in-house staff.

Aone’s BAS services are built to help you stay compliant, minimise risks, and focus on what matters most, running your business.

Your business compliance requires on-time BAS lodgment management while effective cash flow needs and penalty avoidance depend on it. Using preplanning and maintaining precise financial records allows you to perform smooth tax compliance while focusing on business growth without dealing with late lodgments.

Users who experience difficulty preparing their BAS should work with a registered BAS or tax agent like Aone Outsourcing Solutions to receive professional guidance that enhances accuracy and simplifies the process. When you take action before your tax obligations become necessary, you can manage your business operations with full assurance of meeting all the required regulations efficiently.

Your business will achieve success by identifying your upcoming BAS dates for 2025-2026 and scheduling record maintenance in advance while utilising available support tools. Being ahead of schedule will make your tax time preparation efficient through knowledge and advanced planning.

A BAS (Business Activity Statement) is a form that Australian businesses use to report and pay taxes such as GST, PAYG instalments, PAYG withholding, and other obligations. Any business that is registered for GST must lodge a BAS, either monthly, quarterly, or annually, depending on their turnover and ATO requirements.

The BAS due dates for 2025–2026 depend on your reporting cycle:

Monthly BAS : The monthly BAS is due on the 21st of the following month.

Quarterly BAS: The Quarterly BAS is due dates on 28 October, 28 February, 28 April, and 28 July (with agent extensions available).

Annual BAS is due by 31 October 2026, unless lodged with your tax return.

If you lodge your BAS late, the ATO may apply a Failure to Lodge (FTL) penalty and General Interest Charges (GIC) on any unpaid tax. The longer the delay, the higher the penalty. You may also face withheld refunds and compliance scrutiny.

If your BAS due date falls on a weekend or a public holiday, then you have until the next business day to lodge and pay. For example, if your quarterly returns are due on 28 October but this due date falls on a Saturday, then you will have until the month (30 October) to lodge and pay. This applies to lodgement dates for monthly BAS as well as all other lodgement and payment cycles.

If you’re looking for a BAS refund, it typically takes around 14 days for the funds to be received once the ATO has processed your BAS. However, this thing also depend on your individual circumstances also sometimes the ATO’s workload.

Yes, if you work with a registered BAS or tax agent, you may receive an automatic extension for quarterly BAS lodgements—typically an extra 3–4 weeks. Extensions are not always available for monthly BAS.

You can log into your ATO Online Services for Business, myGov (for sole traders), or consult your registered BAS agent. Many accounting software platforms like Xero and QuickBooks, also show due dates within the dashboard.

Yes, businesses can lodge BAS themselves using the ATO’s Business Portal, MyGov, or compatible accounting software. However, using a BAS agent ensures accuracy, timely submission, and access to lodgement extensions and expert advice.

Yes. Even if your business had no income or expenses, you must still lodge a nil BAS to stay compliant with the ATO. If you fail to lodge, it can result in penalties.

Your BAS may include: GST collected and paid, PAYG instalments (if applicable), PAYG withholding (if you employ staff), Other industry-specific taxes like fuel tax credits, luxury car tax, or wine equalisation tax

At Aone Outsourcing Solutions, we believe smart businesses don’t just manage their accounting; they streamline their accounting process. With years of experience supporting accounting firms and businesses across the UK, USA, Canada, Australia, and Ireland, our team knows how to turn everyday financial processes into strategic advantages.

From bookkeeping and payroll to tax preparation, accounts payable, and compliance, weve helped firms simplify their accounting workflows, cut operational costs, and maintain complete accuracy at every step.

Because at Aone, your accounting success is the goal we care about most.

Content on this website is shared for general awareness and educational purposes only. It should not be taken as financial, accounting, taxation, or legal advice. At Aone Outsourcing Solutions, we do our best to keep all information relevant and accurate; however, we can’t promise that every detail is up to date or fits every business situation. Because regulations and compliance requirements can change, we encourage you to seek guidance from an expert professional before acting on any information on this site. Aone Outsourcing Solutions will not be responsible for any decisions made or losses incurred based on the material published on this website. For advice specific to your business needs, please get in touch with our team .

Special characters are not allowed.