GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

For a business owner in Australia, you are probably doing a dozen things at once, aren’t you? With addressing staff, attending to your customers, and striving to build your business, it’s easy for your books to take a back seat. And bookkeeping is not something that can be put off, particularly if you have GST, payroll, BAS lodgements and ATO deadlines to contend with.

That’s where outsourcing comes in. More Australian businesses are switching to outsourced bookkeeping and accounting services to save time, reduce costs and have accurate and compliant finances. Whether it’s bank reconciliations, financial reports or payroll or dealing with payroll, it’s best to let the professionals handle it, and you can be at peace.

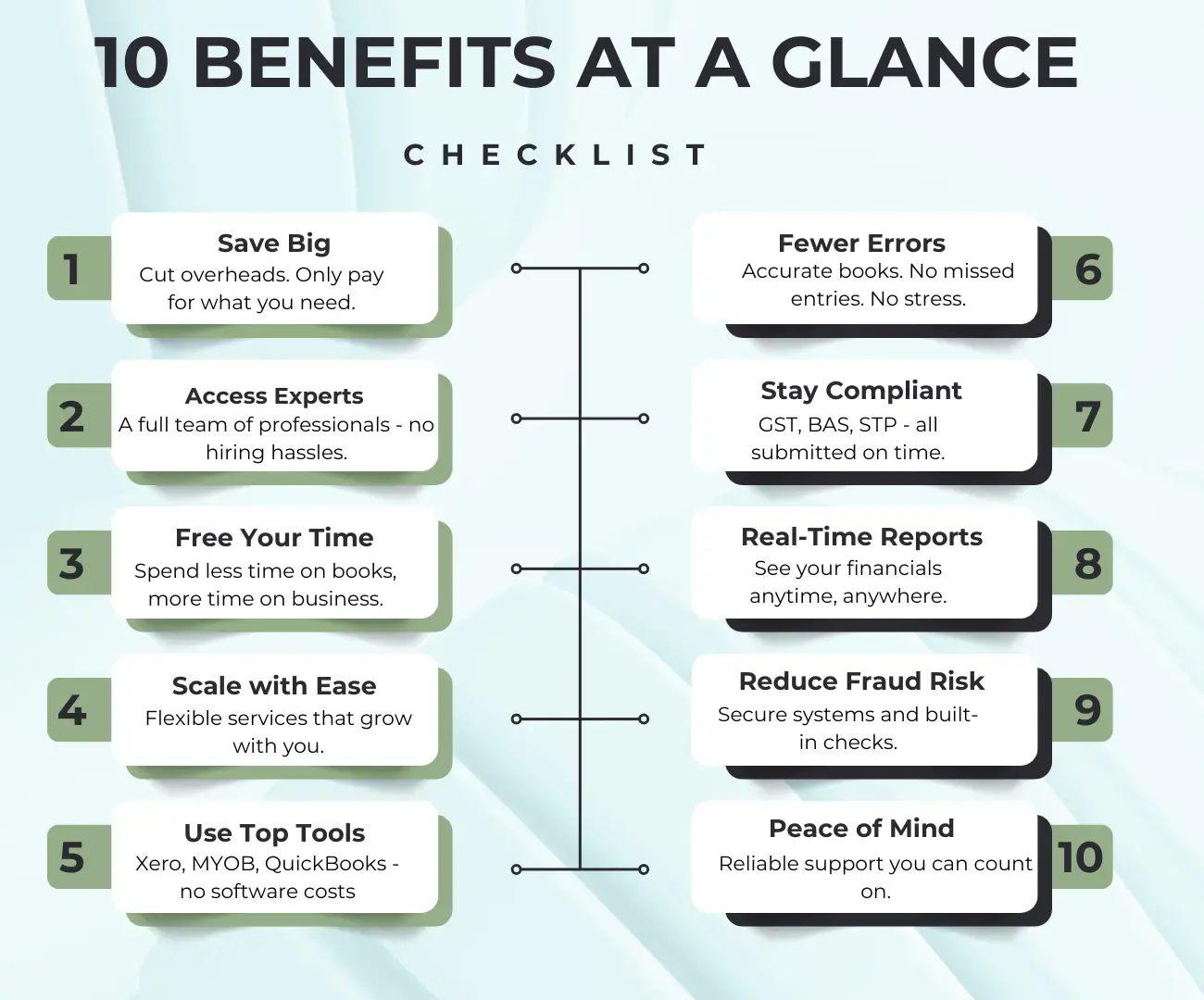

In this blog, we will talk about the top 10 benefits of outsourcing bookkeeping and accounting services. Here you will learn how it can assist you to be organised, avoid costly mistakes and make better financial decisions – all while you focus on running your business.

Risks & How to Mitigate

Outsourcing your books to permanent on-site employees is very expensive in terms of overheads, like salary, leave entitlements, office accommodation and continuing learning. And yet most businesses do not need a full-time bookkeeper, particularly during the beginning or the growth levels.

When you choose outsourced bookkeeping, you get to pay only for what you require. Whether it is monthly reconciliations, weekly payroll, or quarterly BAS lodgements, you benefit from cost savings and professional advice without the associated cost of having a full-time employee.

Outsourcing eliminates recruitment costs as well as in-house admin but offers high-quality output. In fact, the majority of providers use advanced technology and standard processes to make sure your accounts are correct and compliant, while sometimes even being more affordable than running it yourself.

When you outsource your bookkeeping services, you are not just employing one person, you are gaining access to a team of well-trained specialists who understand Australian tax, industry legislation, and cloud accounting software.

Such specialists usually have many years of experience working in many industries, so they offer perspective and solutions applicable to your business model. They will be across the latest changes in ATO requirements and your compliance obligations, so nothing falls through the cracks.

By employing industry experts, you are engaging their technical knowledge, efficiency, and their best practice thinking into your operation, which will hopefully enhance your business's financial capability.

You are better off growing your business rather than chasing after invoices, balancing accounts, and reading financial reports. When you outsource for your bookkeeping and accounting needs, you get out of the weeds and into what matters: the care you take over your customers, the improvement of your product, and the increase of your revenue.

Consider this: every hour you are updating spreadsheets or running payroll is an hour lost that you could have spent building your brand or growing your business. Outsourcing the back office leaves you with the time to make strategic decisions and long-term planning.

Delegating finance tasks is not just time-saving but a way of giving you room to think, innovate, and lead better.

The financial needs of your business will also continue growing as it increases in size. What helped you when you had five clients might not be suitable for you any longer once you’re dealing with five times as much. Bookkeeping accounting services you outsource offer you to scale down or scale up based on the current load.

While internal staff recruitment needs to be contracted, inducted, and trained, outsourcing enables you to grow your support levels swiftly and simply. Are you in need of assistance at the end of the financial year? No worries. Does a downturn in the season mean you are going to cut services? Easy as that.

Your outsourcing company does as you do, offering flexible packages to address changing business shape without the long-term commitment or cost burden of permanent recruits.

Advanced online bookkeeping systems in Australia now employ the most advanced platforms like Xero, MYOB, or QuickBooks. They employ these applications to automate anything from bank reconciliations to automatic invoicing, expense tracking, and instantaneous financial reporting.

As an owner of a business, you can use this technology without making lots of investments in software, upgrades, or training. Your outsourcing partner manages the setup, maintenance, and integration so that your financial systems will smoothly and securely function.

Even better, cloud-based software means you can access your company’s financial performance at any time, from anywhere. Regardless of whether you are in the office or not, you will be able to have instant access to figures that you require making sound decisions.

Incorrect financial records could be more than just a big annoyance—correct records can cost money and cause late payments and compliance failures. Small errors in accounting can and will spiral out of control over time, affecting the cash flow to the tax filings.

When professional bookkeeping and accounting are outsourced, there is a focus on precision. Outsourced bookkeeping service providers systematically follow procedures, check entries and operate automated software to eliminate human errors. Whereas one in-house employee is doing many tasks, your outsourced staff is dedicated to ensuring that every transaction is entered accurately.

Accurate books will give you a clear picture of your business financial position which will help you make better decision, reduce wastage and plan confidently.

Staying on top of evolving tax laws, superannuation policies, and reporting requirements in Australia can be quite a nightmare, especially if you are not a financial guru. Penalties or audits from the ATO can easily be triggered by a mere oversight or missed deadline.

By outsourcing your bookkeeping (Australian), you have. Peace of mind in knowing that your compliance is being well handled. Professional providers stay updated with regard to legislative changes, whether it is Single Touch Payroll (STP), GST, and BAS reporting.

They ensure that all lodgements, filings, and obligations are made in a timely and efficient manner to avoid legal problems and penalties in the form of money. In other words, you simply remain compliant without doing anything.

Making decisions well starts from having sound information, and that’s exactly what online bookkeeping services Australia offer. After your books are up to date, you get up-to-date financial figures that truly reflect the true situation of your business at any particular time.

Outsourced service providers work in the cloud with the portals in which you can view dashboards, run reports, and monitor cash flow anywhere at any time. Whether it’s the time for taxes, you want to set up a plan to invest, or apply for a loan, this visibility is invaluable.

Instead of waiting for end-of-month metrics or doing totals in the manual mode, you can derive insights on demand and base your decisions on them.

The small companies are most vulnerable to financial fraud due to the lack of internal controls. When one person manages incoming and outgoing finances, the possibility of fraud is higher, because it is not noticed.

Outsourcing your accounting and bookkeeping work gives you an added check. Most providers have strict checks and approval processes, and segregation of duties to protect your company from internal fraud and financial abuse.

In addition, professional services are established on open systems and traceable records, and it is easier to audit and detect anomalies early. When reporting independently and being accountable to the outside world, you have improved financial security and trust in the operation.

Being an entrepreneur is tough enough, you shouldn’t be worrying at night over whether your books balance or whether you’re going to make a tax deadline. When you outsource your need for bookkeeping, you diminish some of that stress.

Instead of trying to rush to have figures reconciled or compliance achieved at the eleventh hour, you can rest assured that your finances are under the care of professionals who are dedicated to you. You will have timely submission, reports, as well as advisory support at the time you require.

In the end, the real value of outsourced bookkeeping services is the peace of mind of knowing that your needs are taken care of. You will have the freedom to run your business with clarity of focus and less hassle, knowing your money is in experienced, professional hands.

Outsourcing your accounting and bookkeeping services is not just about saving time but also getting professional help and enhancing accuracy in dealing with your finances. Whether we are referring to lodging of BAS (Business Activity Statements), the handling of GST (Goods and Services Tax), or to keeping up with payroll and reports, having a competent team at your disposal is of crucial importance.

With the right outsourced bookkeeping service, you can relieve stress, save on costs, and make better business decisions. It allows you to spend more time on building your company while your money will be meticulously taken care of.

Ready to make your finances simple and do what you do best?

Partner with Aone Outsourcing to get a trusted bookkeeping and accounting service provider in Australia.

We provide tailored solutions, best-in-class processes, and quality expert support every day of the year to make sure that businesses just like you are compliant, orderly, and in a position to grow. Call us to explore how our outsourced bookkeeping can transform your business.

At Aone Outsourcing Solutions, we believe smart businesses don’t just manage their accounting; they streamline their accounting process. With years of experience supporting accounting firms and businesses across the UK, USA, Canada, Australia, and Ireland, our team knows how to turn everyday financial processes into strategic advantages.

From bookkeeping and payroll to tax preparation, accounts payable, and compliance, weve helped firms simplify their accounting workflows, cut operational costs, and maintain complete accuracy at every step.

Because at Aone, your accounting success is the goal we care about most.

Content on this website is shared for general awareness and educational purposes only. It should not be taken as financial, accounting, taxation, or legal advice. At Aone Outsourcing Solutions, we do our best to keep all information relevant and accurate; however, we can’t promise that every detail is up to date or fits every business situation. Because regulations and compliance requirements can change, we encourage you to seek guidance from an expert professional before acting on any information on this site. Aone Outsourcing Solutions will not be responsible for any decisions made or losses incurred based on the material published on this website. For advice specific to your business needs, please get in touch with our team .

Special characters are not allowed.