GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

Running a business today is more than just delivering great products or services, it’s about staying on top of numbers, compliance, and cash flow, all while trying to grow. But here’s the reality: accounting often eats up your precious time, drains internal resources, and leaves business owners stressed about deadlines, errors, or missed opportunities for savings

This is where the benefits of outsourcing accounting truly stand out. By letting experts handle your financial tasks, you gain more time, accuracy, and cost savings without the hassle of managing an in-house team.

In this blog, we’ll break down what outsourced accounting really means, the key benefits it offers, common challenges and their solutions, and how to choose the right partner for long-term success.

At its core, outsourced accounting means handing over some or all of your financial management tasks to an external specialist or firm. Instead of an in-house team, businesses can hire professional accountants who work remotely to manage bookkeeping, payroll, tax filings, accounts payable/receivable, and financial reporting.

It is not about reducing the costs but about strategic delegation. An outsourced provider usually adopts the recent accounting software and tools to make it accurate and efficient. As an example, cloud-based platforms provide businesses with the opportunity to access their financial information anywhere and at any time, and the outsourcing team performs routine tasks.

You get to have your own virtual finance department that can expand as your business does but does not incur a significant overhead expense.

Related blog - Outsourced vs. In-House Accounting: What’s Best for Your Small Business in Australia?

Outsourcing accounting services is not only for large corporations that can afford it, but has become a requirement for small businesses that want to remain competitive without the risk of drowning in the complexities of the financial world.

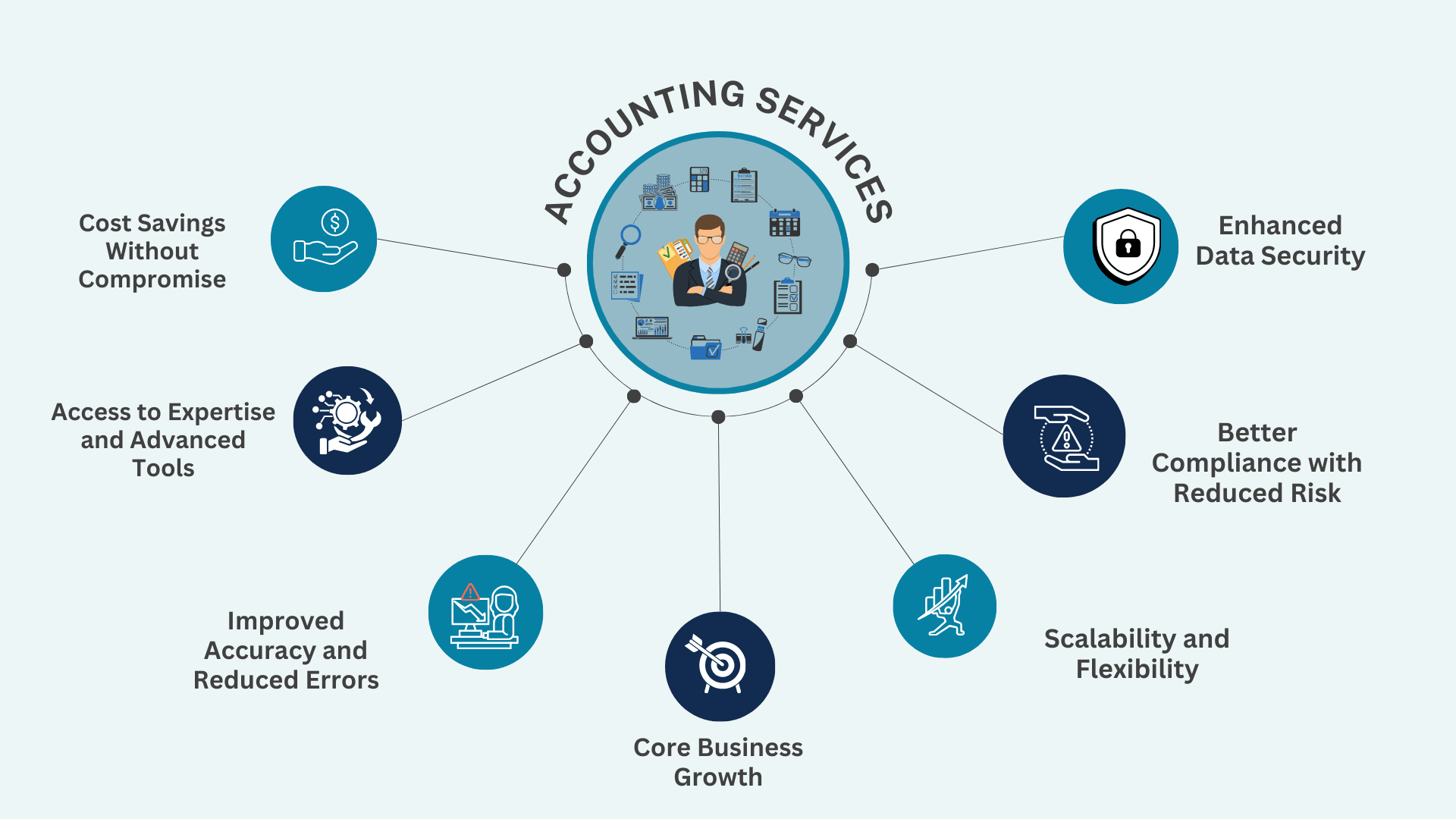

Outsourcing accounting to a reliable firm helps businesses to save on overheads (costs), increase efficiency and concentrate on improving what they are best at: core business. It is time to take a closer look at accounting outsourcing benefits that can help them revolutionize the way their businesses manage their finances.

Cost savings are one of the most significant benefits of outsourcing accounting services. When you employ an in-house accounting department, there are salaries, benefits/funds, software, training and office space to allocate, and that can quickly add up in costs.

Outsourcing, as opposed to in-house, will eliminate these overhead costs and put you in a position to hire highly skilled accountants at a significantly lower price. When businesses outsource accounting, many report saving expenses of 40-60 percent compared to maintaining an in-house staff.

When businesses wonder why to outsource accounting services, the answer often lies in expertise. Outsourcing companies have on board qualified professionals who are informed about current tax regulations, compliance, and best practices.

In addition, several companies have access to higher levels of accounting and bookkeeping software that could be beyond the reach of small businesses. But with outsourcing accounting services, you get accurate bookkeeping and receive helpful insights by using the latest financial tools.

Human error can create costly mistakes when you manage your finance. A misplaced decimal or missed compliance deadline can lead to penalties, cash flow disruptions, or even reputational damage. Businesses that utilize outsourced accounting services benefit from teams that adhere to stringent review procedures and employ automation to minimize errors. This will facilitate proper bookkeeping, excellent reporting and hassle-free compliance.

Hundreds of business owners waste their time with invoices, reconciliations and tax preparation, which they could employ to expand their business. Outsourced accounting assists you in delegating such duties, regaining some time, and allowing you to focus on actual operations, client relations, and business development. This implies that outsourcing has the benefit of relieving the leadership of the financial paperwork to create long-term value.

Another important benefit of outsourcing services is that you get scalability. Whether your business is a startup handling a few transactions or an established company with complex multi-entity accounts, outsourcing adapts to your needs.

During peak seasons like year-end tax time, you can scale up support without hiring new staff. When things slow down, you can scale back without worrying about layoffs or wasted payroll costs.

Regulatory compliance is becoming one of the major complexities of accounting. From tax law updates to payroll obligations, businesses face a constant stream of changes. Outsourcing firms monitor these regulations to check that your business complies with local and international laws. It always reduces the risk of audits, penalties, and legal complications because your books are always up to date.

The advantages of outsourcing accounting services can help you in several ways, one of which is the protection of sensitive information. Expert outsourcing firms use robust security measures, such as encrypted databases, protected systems, and multi-layered security, which are out of reach for most small businesses. Protecting your customers' personal and financial data from fraud and hackers is a top priority for any reputable business.

Now, as a business owner, you must have understood why outsourcing accounting services is a good decision for your business.

Related Blog:- How Can Outsourcing Accounting and Bookkeeping Help Accountants Achieve Work-Life Balance?

Outsourcing isn’t just for large corporations; it’s equally beneficial for small businesses. Some signs your company should consider it include:

You’re spending more time on accounting than running your business.

Financial reporting errors are becoming frequent.

Payroll and tax compliance feel overwhelming.

You can’t afford a full-time accountant.

You’re planning for rapid growth and need scalable solutions.

Your BAS/GST or STP submissions are frequently late.

You need an Xero/MYOB-fluent team without hiring full-time.

In short, if your accounting responsibilities are slowing you down or draining resources, it’s time to explore outsourcing.

While outsourcing accounting brings numerous benefits, it also presents its challenges. The good news? Each challenge has a practical solution if handled smartly.

Challenge: Raising the question of possible confidentiality and cyber safety when disposing of financial information to an outside provider.

How to solve it: In order to secure your information, you should work only with outsourcing companies that use strict measures to protect data such as encryption, the use of secure servers, and signed data protection agreements that include nondisclosure clauses.

Challenge: There may be delays and problems caused by communication imprecision or time zone differences.

Solution: In order to make sure that nothing is left by the wayside, choose a supplier who has open communication channels and set the expectations clear, just so that regular updates are given.

Challenge: Inability to control the level of control over your financial operations is one of the challenges that affect some businesses when they decide to outsource accounting services.

Solution: A reliable outsourcing partner will help you with the real-time dashboards, transparent reporting, and regular check-in so that you can manage your accounting easily.

Challenge: Not every outsourcing company may deliver the same level of accuracy and quality.

Solution: In order to ensure zero errors in accounting, team up with suppliers that have experienced CPAs, industry expertise and have well-established control systems on quality.

Challenge: The work cultures and practices can be diverse and sometimes conflict may arise.

Solution: Inform your partner about the specific requirements of your company, create a transparent process of onboarding and coordinate workflows in advance.

Not all providers are created equal. Here’s what to look for when outsourcing:

Expertise within your industry: Select an outsourcing company with experience within your specific line of business (e.g. retail, e-commerce, professional services).

Technology Proficiency: Ensure they use updated cloud accounting software like Xero, QuickBooks, or NetSuite.

Transparent Pricing: Avoid hidden charges; look for flexible packages that fit your budget.

Proven Track Record: Check reviews, testimonials, and case studies.

Dedicated Support: A strong partner must serve as a part of your team not a vendor.

A trustworthy outsourcing partner doesn’t just crunch numbers, they provide insights that shape growth strategies.

Related Blog:- Australian Accounting Firms: Why Choose Outsourced Bookkeeping and Accounting Services?

Nowadays, outsourcing accounting services is a wise business growth strategy rather than just a way to cut costs. Businesses can access top-tier financial expertise, lower compliance risks, streamline operations, and concentrate their time and energy where it counts most, growing the business by partnering with the right outsourcing company. Outsourcing provides solutions that are customised to meet your needs, whether you're a startup seeking flexible support, a growing SME requiring sophisticated reporting, or an established business trying to reduce expenses.

At the end of the day, the real benefit of outsourcing accounting lies in freedom, the freedom from repetitive financial tasks, from the stress of compliance, and from the high cost of in-house teams. With the right partner, outsourcing doesn’t just manage your books, it helps write your success story.

From bookkeeping and accounts payable to tax prep and compliance, our expert team ensures accuracy, efficiency, and cost savings at every step. You can focus on growing your business while we will manage your accounting books.

You can now connect with us today and discover a more innovative way to manage your accounting operations.

At Aone Outsourcing Solutions, we believe smart businesses don’t just manage their accounting; they streamline their accounting process. With years of experience supporting accounting firms and businesses across the UK, USA, Canada, Australia, and Ireland, our team knows how to turn everyday financial processes into strategic advantages.

From bookkeeping and payroll to tax preparation, accounts payable, and compliance, weve helped firms simplify their accounting workflows, cut operational costs, and maintain complete accuracy at every step.

Because at Aone, your accounting success is the goal we care about most.

Content on this website is shared for general awareness and educational purposes only. It should not be taken as financial, accounting, taxation, or legal advice. At Aone Outsourcing Solutions, we do our best to keep all information relevant and accurate; however, we can’t promise that every detail is up to date or fits every business situation. Because regulations and compliance requirements can change, we encourage you to seek guidance from an expert professional before acting on any information on this site. Aone Outsourcing Solutions will not be responsible for any decisions made or losses incurred based on the material published on this website. For advice specific to your business needs, please get in touch with our team .

Special characters are not allowed.