GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

Is your accounting firm overwhelmed during peak tax season? The tax season leaves Australian accountants with surging pressure, restraining deadlines, rising client requests, and a lot of paperwork. With the coming of July, most companies find the number of jobs and their quality very difficult to cope with. Tax return preparation errors, late lodgements, or failure to comply may create not only dissatisfied clients, but also regulatory problems.

Whether you happen to be a solo practitioner or a growing firm, the bottom line is that internal resources can be overstretched when busy seasons hit. The difficulty is not simply in volume control but also in assuring that all tax return services are properly performed to the most recent Tax Return Australia standards and ATO filing criteria.

Here, the tax return outsourcing services are a scalable and cost-effective solution. Outsourcing the tax-related processes to reputable, experienced individuals helps the accountants in Tax Return Australia to simplify their operations, eliminate stress and provide quality services to clients. When you find the right tax return services partner, you end up with some flexibility as well as peace of mind, which is needed most in the busiest months of the year.

Tax return outsourcing services involve the delegation of your tax compliance and preparation work to a specialist third-party provider who operates on behalf of your firm and may do so either on a white-label basis. These providers have a good understanding of the tax return Australia laws and may be able to assist the firms in providing timely and compliant services to their clientele.

The tax preparation services often comprise:

Tax return preparation of individuals, businesses and trusts.

Review and electronic lodgement accommodation, including tax filing services.

Lodgement to the ATO according to the present rules.

Assistance with Business Activity Statements (BAS) and Instalment Activity Statements (IAS).

Testing of supporting documentation.

Quality controls are carried out to check on accuracy, survival eligibility and audit risks.

Outsourcing these tax return filing services will allow your firm to cover all compliance needs and enable your internal staff to work on projects with higher value in terms of advisory activity. When you have dependable procedures to file and prepare tax returns, you can say goodbye to end-of-the-year panicking, severe delays, and lost client confidence, even with the highest workloads of the year.

Hiring a provider specialised in Australian tax preparation services helps the accountants to have skilled practitioners who are up to date with the changes in legislation, since accountants report error-free and documents aligned with the ATO.

Outsourcing is no longer a last resort option for thoughtful accounting firms in Australia during the hectic tax season. Tax returns outsourcing is the service that provides numerous advantages to accountants, including workload management, compliance, and many more. This is how this solution is catching up in the industry:

Outsourcing is no longer a last resort option for thoughtful accounting firms in Australia during the hectic tax season. Tax returns outsourcing is the service that provides numerous advantages to accountants, including workload management, compliance, and many more. This is how this solution is catching up in the industry:

Among the most notable benefits of tax return outsourcing services, you can ramp up your operations at any moment--with no long-term personnel costs. When there is intense work, it is common that the firms receive a rush of files belonging to clients, and these files may overwhelm even the best of teams.

Temporary employees are not only recurrent and expensive but also require onboarding and training mediums. Under outsourcing, you can add or deduct capacity depending on the workload, be it 20 returns you need to outsource or 200 returns. Such a flexible model implies that you are ready all the time to process thrilling amounts without compromising the turnaround time and quality.

The cost of hiring in-house tax preparers, training, and retaining them is quite high, considering that your firm only requires them when tax season arrives. When you outsource, you do away with these overheads and obtain talented expertise at a standardised, reasonably priced cost.

You do not pay full-time salaries together with committing to training programmes; you pay for what you are using. This exigency of controlling the cost renders the tax filing services really appealing to small and mid-sized accounting firms aspiring to have sustainable growth.

During tax time, money equals time. Customers prefer getting service quickly, and when it is not provided, the reputation of your firm may be ruined. Through collaboration with a tax return outsourcing services provider with a time zone that differs from yours, the advantage of real-time processing accrues.

By the time you give out files at the end of your working day, they are in the processing mode as your team is asleep. A 24-hour cycle has the possibility of halving the turnaround time to enable you to find yourself on either side of tight deadlines and also to assure your clients more satisfaction.

Tax return preparation errors may cause audits, fines, and the distrust of the client. When a person outsources the task of tax preparation services to the experts who specialise in ATO regulations, higher accuracy and compliance are guaranteed.

These professionals work through elaborate checklists, perform extensive research and are well informed of the changing tax laws in Australia. This causes your clients to get ATO-aligned documentation that lowers error rates and improves the general quality of your service.

Moreover, such outsourcing opportunities as Aone use more quality control checks and compliance procedures, providing you with an additional sense of security associated with your filing process.

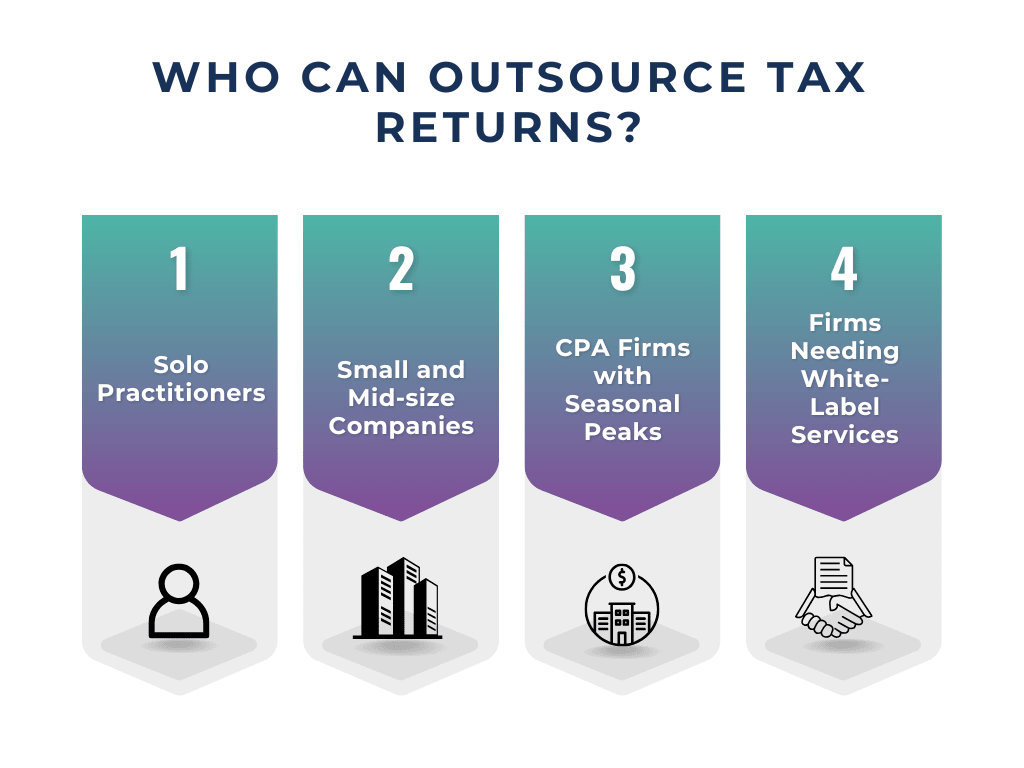

Outsourcing of tax returns and tax preparation is not a one-size-fits-all strategy; it is a flexible approach that can be used in any business of any size. Be it an individual accountant who is attempting to keep pace with the doubling paperwork or a multi-partner firm that aims to make seasonal work more fluid, outsourcing has its obvious benefits.

Outsourcing of tax returns and tax preparation is not a one-size-fits-all strategy; it is a flexible approach that can be used in any business of any size. Be it an individual accountant who is attempting to keep pace with the doubling paperwork or a multi-partner firm that aims to make seasonal work more fluid, outsourcing has its obvious benefits.

Many independent accountants have to handle tax returns, communications with clients, advice given, and organisation as a one-man team. This may be a nightmare whenever peak tax season occurs. When the tax returns are outsourced, the solo practitioners become empowered because they are able to handle more work than before without facing burnout or accuracy issues.

These companies usually do not carry much in-house capability, and they do not always have the funds to increase their workforce in the short term. Outsourcing of tax returns enables them to have more workload, and at costs that are affordable. This makes it easy to sustain the quality of tax filing services and the satisfaction of its clients without having to endure long-term commitments.

When tax season comes, the increase in volume is at its peak in CPA firms, yet it is economically unsound to provide such a large number of employees throughout the rest of the year. Outsourcing offers variable assistance, which can be done depending on the seasonal demands, and firms can stick to deadlines, and they will not experience bottlenecks internally.

In companies that provide white-label solutions, outsourcing allows smooth completion of a service without a hint of third-party participation. The clients of yours still get professional, ATO-compliant tax filing services, and your firm keeps complete control of the relationship and your branding.

Outsourcing tax preparations can give you all-year-round support or just seasonal backup when the need arises. In this case, when you outsource tax preparations, you have the operational flexibility that every modern accounting firm requires to succeed.

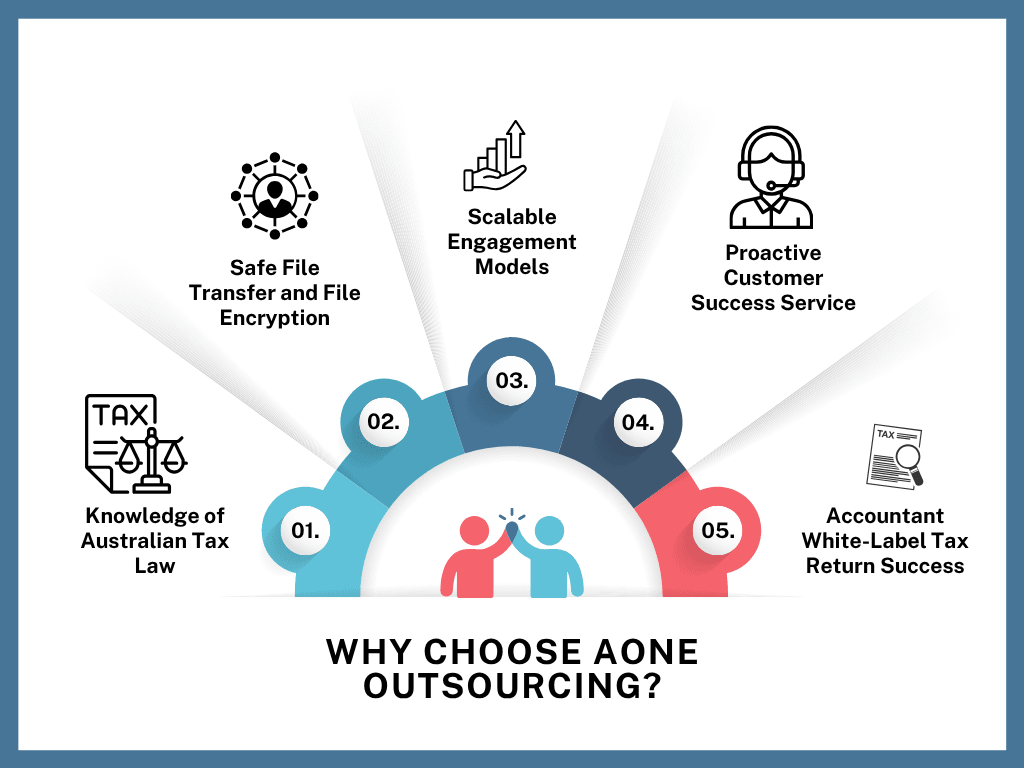

The task of finding a good provider to outsource to is not easy. We have established a reputation at Aone Outsourcing with the provision of reliable, safe and scalable tax support to Australian accountants. The reasons why companies all around Australia decide to cooperate with us are as follows:

The task of finding a good provider to outsource to is not easy. We have established a reputation at Aone Outsourcing with the provision of reliable, safe and scalable tax support to Australian accountants. The reasons why companies all around Australia decide to cooperate with us are as follows:

Our practice is made up of competent individuals trained in Tax Return Australia laws and conversant with ATO laws. You will be sure that your tax returns will be correctly filed, lawfully, and that the legislation is updated.

Our confidentiality of data is not a joke. The security of your information includes end-to-end encryption, secure cloud facilities, multi-factor authentication, and highly restricted access internally. We are also in line with the international data protection requirements, such as ISO 27001.

It does not matter whether you are outsourcing 10 returns or 1,000; our team adapts. Our flexible engagement plans enable you to increase or decrease your engagement, as needed, whether it be seasonally or continuously--without any long-term lock-in.

Our account managers stay in touch with you and smooth down the communication process, quick fixability of queries and tracking the workflow. We will not lay claim to being a service provider, but as part of your in-house team.

In the meantime, we are behind the scenes and still maintain your brand identity. With our white-label services, you get to present your clients with timely, ATO-compliant and professional tax returns without disclosing the outsourcing source.

We have fair and open prices that offer predictability in costs and a guarantee in delivery schedules that you can build in planning. We assist you in meeting even the shortest deadlines as we have access to round-the-clock processing through time zone advantages.

You may want to increase your capacity, develop better turnaround times, or increase profitability; Aone Outsourcing will help you with confidence, full compliance, data protection, and, more importantly, your success.

Tax season should not become a notion of stress, short deadlines, and late returns. To Australian accounting firms, outsourcing of tax returns is a potent method of handling rising workloads without compromising quality, accuracy and compliance.

Outsourcing tax preparation and filing of tax return services not only brings efficiency on your side but also in rendering the tax preparation and filing services to the clients, thus increasing client satisfaction. As a lone practitioner or as a growing CPA firm, Aone Outsourcing is the answer to ensure that you are ahead of the curve.

Our team acts like working as a branch of your firm; your team goes about its business, without us making any noise about it, safeguarding that all returns are filed accurately and in time, time after time.

Are you ready to take over tax season?

Collaborate with Aone Outsourcing to get reliable tax returns preparation and filing assistance from Australian accountants. Get a personalised quote today and find out how outsourcing can help you make your busiest season your most productive season.

A price quote for doing your tax preparation with an accountant in Australia will cost you an average of 100 to 300 Dollars on individual tax returns, depending on the complexity of your financial matters. To sole traders or those with investments and numerous sources of income, fees may be charged at a higher amount. Depending on the size and range of services, business and company tax returns can range in cost from 500 dollars and 3000 or above. The majority of the accountants will charge a flat fee, whereas others are likely to charge an hourly rate for complicated matters.

Yes, as an Australian citizen/resident, you can fill out and submit your Australian tax returns as an overseas resident. The payment of taxes in Australia can be made easily with the Australian Taxation Office (ATO), as it allows online lodgment through myGov or registered tax agents; one can access their taxation responsibilities wherever they are. When you are an expat or are temporarily residing outside Australia, you should keep proper records about your income in Australia and your Australian residence status so that you can be prepared for your tax liability and entitlement to deductions.

Yes, generally Australian tax residents are expected to be taxed on their global income that comprises income earned locally and internationally. This consists of salaries, rent, dividends and capital gains of foreign assets. Non-residents, however, are only liable on the income that is Australian-sourced.

The overall price that most accountants will charge to prepare tax returns will be dependent on complexity. When it comes to normal personal returns, the expenditure will be within a range of 150-250 US dollars. Complications include returns that involve rental properties, capital gains, or sole trader income at a range of between $300 and 600 and more.

At Aone Outsourcing Solutions, we believe smart businesses don’t just manage their accounting; they streamline their accounting process. With years of experience supporting accounting firms and businesses across the UK, USA, Canada, Australia, and Ireland, our team knows how to turn everyday financial processes into strategic advantages.

From bookkeeping and payroll to tax preparation, accounts payable, and compliance, weve helped firms simplify their accounting workflows, cut operational costs, and maintain complete accuracy at every step.

Because at Aone, your accounting success is the goal we care about most.

Content on this website is shared for general awareness and educational purposes only. It should not be taken as financial, accounting, taxation, or legal advice. At Aone Outsourcing Solutions, we do our best to keep all information relevant and accurate; however, we can’t promise that every detail is up to date or fits every business situation. Because regulations and compliance requirements can change, we encourage you to seek guidance from an expert professional before acting on any information on this site. Aone Outsourcing Solutions will not be responsible for any decisions made or losses incurred based on the material published on this website. For advice specific to your business needs, please get in touch with our team .

Special characters are not allowed.