GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

Does your accounting firm feel the burden of increased costs, regulation, and staffing slowing its growth?

Most Australian accounting firms today face the challenges of maintaining efficiency in the current dynamic business environment as they balance the requirements imposed on them by compliance requirements and the reduced number of professionals to draw on. The pressure to be accurate, fast and strategic increases, whereas internal teams are mostly overstretched.

As a way of fighting these problems, an increasing number of companies are looking to outsourced accounting services as a solution that is both modern and effective. Outsourcing time-consuming financial operations to dedicated teams helps firms to save on expenses, get access to expertise and shorten turnaround time, all without sacrificing quality.

Whether in the form of day-to-day bookkeeping or creation of comprehensive financial statements to be submitted to ATO, outsourced accounting and bookkeeping enables companies to be compliant, responsive and flexible as well as focused on their key business of serving clients. With a changing landscape, accounting outsourcing service adoption is no longer a cost-saving measure, but a competitive edge.

This blog will discuss the nature of outsourced accounting bookkeeping, the reasons why it is becoming popular in Australia, and how Aone Outsourcing can make your firm successful in a rapidly evolving market environment.

Outsourced accounting and bookkeeping services include contracting an external provider to run the financial functions of your firm. Rather than employing full-time in-house employees, accounting firms outsource work to a team of experienced experts who work remotely on cloud-based systems. The model will aid in cutting overheads, enhancing accuracy, and providing 24-hour access to financial information.

Such services normally encompass ledger maintenance services, payroll services, BAS lodgement services, accounts reconciliation services and financial reports. By using contemporary cloud-accounting software, such as Xero, MYOB, and QuickBooks, businesses take advantage of real-time updates, secure data management, and easy cooperation.

Through the outsourcing of accounting service providers, companies are in a position to concentrate on more strategic tasks as well, while leaving the day-to-day operations in the capable hands of those who are compliant and efficient. The benefits of outsourcing services do not end in cost-saving; it is a scalable service that can adjust itself according to the size of your business, hence whether you are a small practice or a big accounting firm, outsourcing is the right solution.

More and more Australian accounting firms are deciding to outsource bookkeeping and accounting services, and it has more reasons than cost reduction. The principal business forces driving this change are as follows:

More and more Australian accounting firms are deciding to outsource bookkeeping and accounting services, and it has more reasons than cost reduction. The principal business forces driving this change are as follows:

The cost of hiring, training and maintaining in-house staff may be high, particularly in a competitive labour market. Through the outsourced accounting services, firms are also able to reduce their operational costs considerably without compromising the quality of the services provided. No extra costs are incurred in the form of office rent, software license fees or employee welfare.

Outsourcing accounting and bookkeeping services introduces you to skilled experts in Australian taxation, BAS compliance, payroll processing and cloud software. Through accounting and outsourcing firms in Australia, companies can tap into a talent pool of professionals without the deficits of an in-house recruitment.

Whether you are a growing practice or a larger firm with seasonal demands, outsourcing offers a flexible paradigm that adjusts to your demands. Accounting and outsourcing a flexible solution because you can increase or decrease the level of support depending on the demands of the clients.

An error in financial reporting or tax filing may result in a penalty and loss of reputation. When outsourcing accounting and bookkeeping, work is done by specialists who know all the recent ATO guidelines, which means complete compliance and accuracy in reporting.

Partners and internal teams will be able to devote their time to client relationships, advisory services and business development by delegating time-consuming financial processes. Through account outsourcing services, firms are able to channel their time in formulating growth strategies rather than engaging in day-to-day procedures.

When Australian firms outsource accounting services to a recognised provider such as Aone Outsourcing, they get access to a large pool of specialised services that not only help to decrease workload but also improve efficiency in operations. Our services are scalable to your business requirements, such as being a sole practitioner, a midsized firm or an emerging business.

When Australian firms outsource accounting services to a recognised provider such as Aone Outsourcing, they get access to a large pool of specialised services that not only help to decrease workload but also improve efficiency in operations. Our services are scalable to your business requirements, such as being a sole practitioner, a midsized firm or an emerging business.

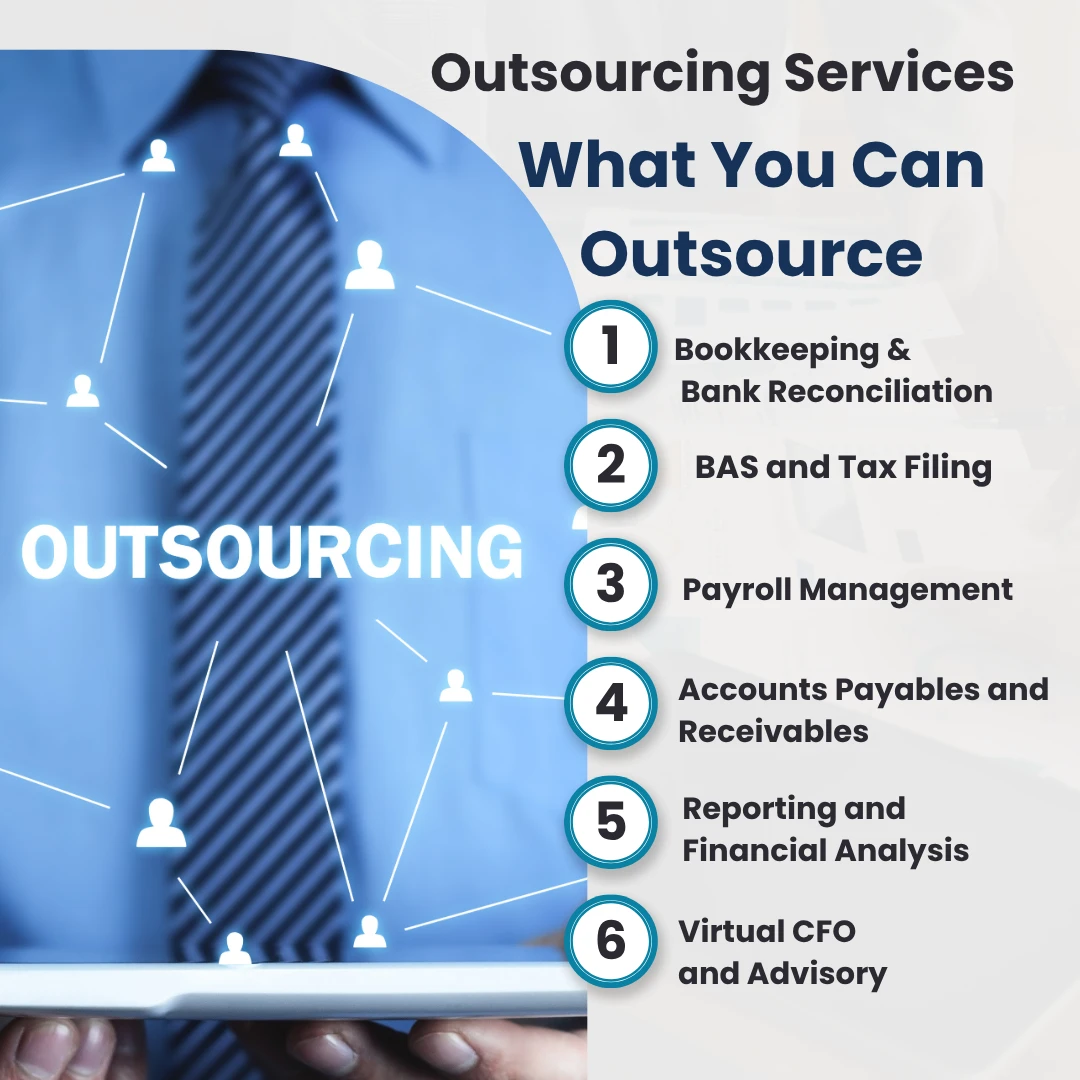

The main outsourcing accounting and bookkeeping services which are offered are as follows:

Bookkeeping and Bank Reconciliation: Sound accounting practice starts with correctly recording the financial transactions and making the daily entries. Through outsourcing, your books will be kept carefully, and the bank reconciliations will be smoothly done, thus avoiding any discrepancies that would render your financial records to be not unaudit-ready.

BAS and Tax Filing: Remain in compliance through the timely preparation and lodgement of Business Activity Statements (BAS), income tax returns and other statutory returns. ATO changes are monitored by outsourced teams, and everything is accurate and carries less risk of penalty.

Payroll Management: Manage weekly, fortnightly or monthly pay run, superannuation, leave management, PAYG calculations and end-of-year payment summaries (STP reporting). Every payroll practice is by the Fair Work and ATO standards.

Accounts Payables and Receivables: The incoming and outgoing invoices can be managed end-to-end to enhance the cash flow. When you outsource these functions, there will be fewer delays, fewer errors, and fewer follow-ups to your internal team.

Reporting and Financial Analysis: Transform simple bookkeeping with useful financial reporting. Get monthly profit & loss, balance sheets, cash flow, and trend analysis - on time to be strategic with your decisions.

Virtual CFO and Advisory: Virtual CFO services can provide backup to firms that want to gain more insights into finance, including advice on financial planning, budgeting, and forecasting. Think of it as access to a CFO, without the expense of a full-time CFO.

In the case of outsourcing accounting and bookkeeping, not everybody on the market can provide the same level of expertise and assistance. Aone Outsourcing is a leading provider of outsourcing services to accounting firms in Australia, with extensive local expertise and international best practice approaches to provide quality, efficient and fully compliant services.

What makes us different is this:

Our bookkeepers and accountants have a thorough understanding of the Australian taxation legislation, the requirements of the ATO, as well as financial regulations. This will make all reports and submissions completely compliant and audit-ready.

Client confidentiality and data protection are of great priority to us; thus, we use encrypted systems, secure file transfers, and restricted access, which cover the utmost privacy and security requirements.

A one is well versed with industry best software such as Xero, MYOB and QuickBooks. Our team operates alongside your established ecosystem, providing real-time observability and collaboration with no disruption.

Regardless of whether you require end-to-end solutions or just outsourced accounting bookkeeping, our solutions are designed depending on the size of your firm, its scope, and seasonal requirements. You will also receive an account manager who will make communication and delivery easy.

We do not hide anything. Whether you need timesheets or financial overviews, you will be able to get coherent, error-free data. We centre our service model on your business aspirations and your client expectations.

Aone Outsourcing is not another vendor- we are an outsourced arm of your practice that enables you to grow, maintain compliance and keep up with the competition in a fast-changing financial environment.

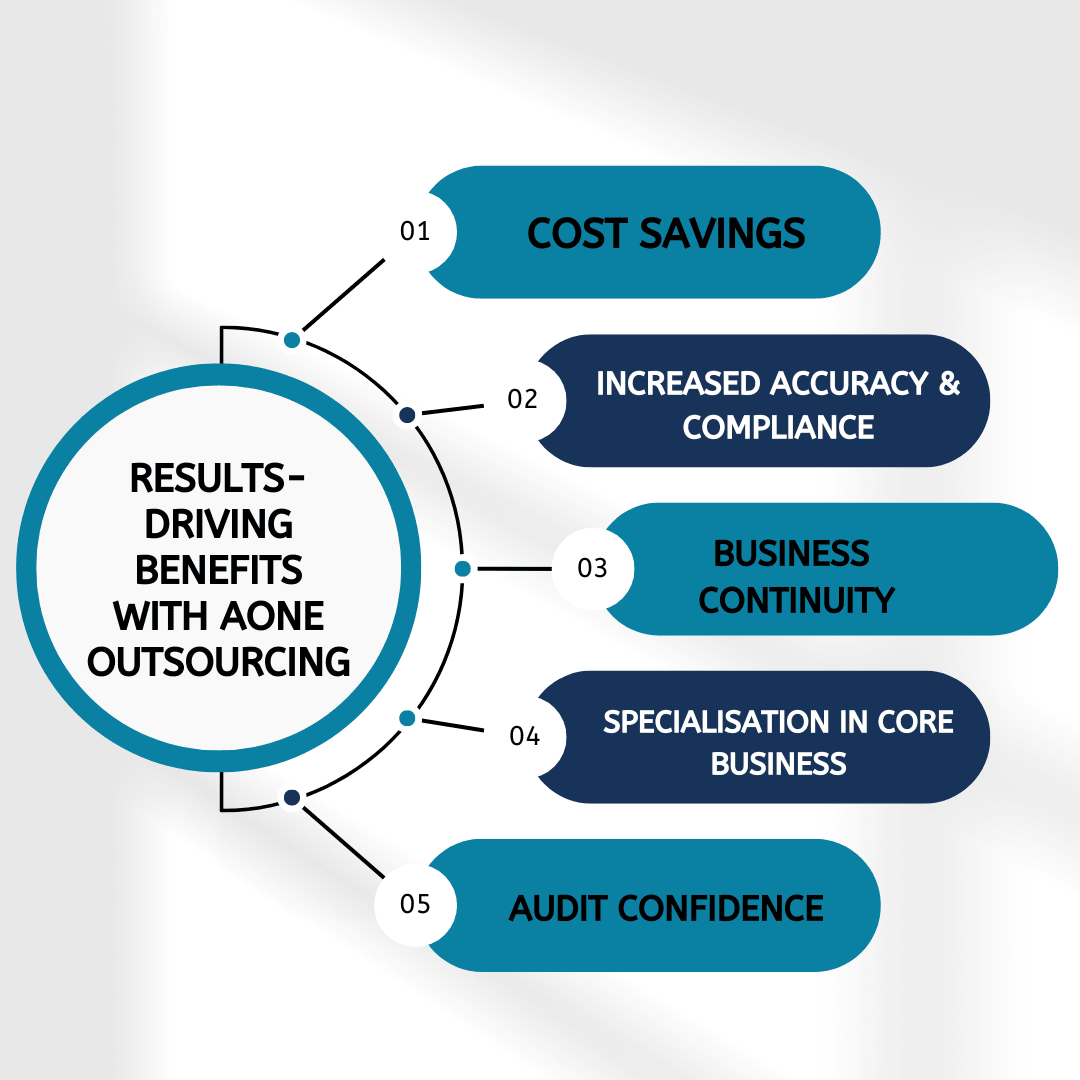

With the cooperation of Aone Outsourcing, accounting firms Australia-wide will gain access to a variety of convenient and result-oriented advantages:

With the cooperation of Aone Outsourcing, accounting firms Australia-wide will gain access to a variety of convenient and result-oriented advantages:

Cost Savings: Cut down on overheads, in terms of salary, software, infrastructure, and recruiting.

Increased Accuracy & Compliance: The professional supervision assures the minimum amount of mistakes, a high standard of reporting, and the full observance of the ATO and Fair Work rules.

Business Continuity: Never disrupt your services again due to an unreliable outsourced team that may take off during the public holidays or when there is a shortage of staff.

Specialisation in Core Business: Allow your in-house team to focus on high-value services such as advisory, planning, and client-facing work.

Audit Confidence: Extensive records and ongoing entries leave you with peace of mind whenever there are audits and financial checks.

All these tangible and intangible returns place outsourcing as an intelligent, future-proof approach to both small and large accounting firms.

Due to the growing complexity and competition in the accounting industry in Australia, firms need to implement solutions that are not only performance-enhancing but also sustainable. Accounting and bookkeeping outsourcing is no longer a temporary measure that accounting outsourcing companies in Australia resort to to fill in the gaps- it is a smart step in the direction of more flexibility, accuracy and development.

With Aone Outsourcing, you get more than just outsourced assistance; you get a reliable partner who has the resources, skills and knowledge to assist you in meeting your long-term objectives. We are the perfect outsourcing partner because of our expert-only services, personalised model, and quality focus.

When you need to simplify your financial processes, save on time and at the same time assure compliance without sacrificing quality, then Aone Outsourcing is the answer.

Contact us now to discuss tailored accounting solutions for your company.

At Aone Outsourcing Solutions, we believe smart businesses don’t just manage their accounting; they streamline their accounting process. With years of experience supporting accounting firms and businesses across the UK, USA, Canada, Australia, and Ireland, our team knows how to turn everyday financial processes into strategic advantages.

From bookkeeping and payroll to tax preparation, accounts payable, and compliance, weve helped firms simplify their accounting workflows, cut operational costs, and maintain complete accuracy at every step.

Because at Aone, your accounting success is the goal we care about most.

Content on this website is shared for general awareness and educational purposes only. It should not be taken as financial, accounting, taxation, or legal advice. At Aone Outsourcing Solutions, we do our best to keep all information relevant and accurate; however, we can’t promise that every detail is up to date or fits every business situation. Because regulations and compliance requirements can change, we encourage you to seek guidance from an expert professional before acting on any information on this site. Aone Outsourcing Solutions will not be responsible for any decisions made or losses incurred based on the material published on this website. For advice specific to your business needs, please get in touch with our team .

Special characters are not allowed.