GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

Running a business in Sydney comes with many responsibilities, and managing your accounts is often one of the toughest. Whether you’re a small business owner, a sole trader, or even a contractor, staying on top of your books, filing tax returns, paying GST, and keeping up with ATO requirements can be overwhelming. Sydney’s fast-moving business environment, combined with constant updates in tax rules, means there’s little room for error. Missing a deadline or entering wrong information in your BAS can lead to penalties, unwanted stress, and lost time.

Many business owners start with the intention of doing their own accounts using basic bookkeeping software Sydney or hiring someone part-time. But very soon, they find themselves buried under receipts, invoices, and compliance documents. With little time to focus on financial planning or growth, business owners in Sydney are often left feeling confused, anxious, and unsure of where their money is really going. That’s where professional help makes all the difference.

Hiring an in-house accountant is not always possible, especially for small business accounting in Sydney. Outsourcing your accounting and tax work to a trusted team like A One allows you to get expert help without the high cost of a full-time employee. More importantly, it gives you peace of mind.

We don’t just handle your day-to-day bookkeeping online Sydney and accounting—we take the time to understand your business, offer the right advice, and help you avoid tax mistakes. You’ll no longer have to worry about missing ATO deadlines, confusing GST rules, or figuring out your deductions on your own.

By choosing to outsource your accounting to a professional Sydney-based firm like ours, you:

Save time to focus on running your business

Avoid costly ATO penalties

Get access to skilled tax return Sydney and payroll Sydney experts

Understand your cash flow and profits more clearly

Make smarter business decisions with the right financial data

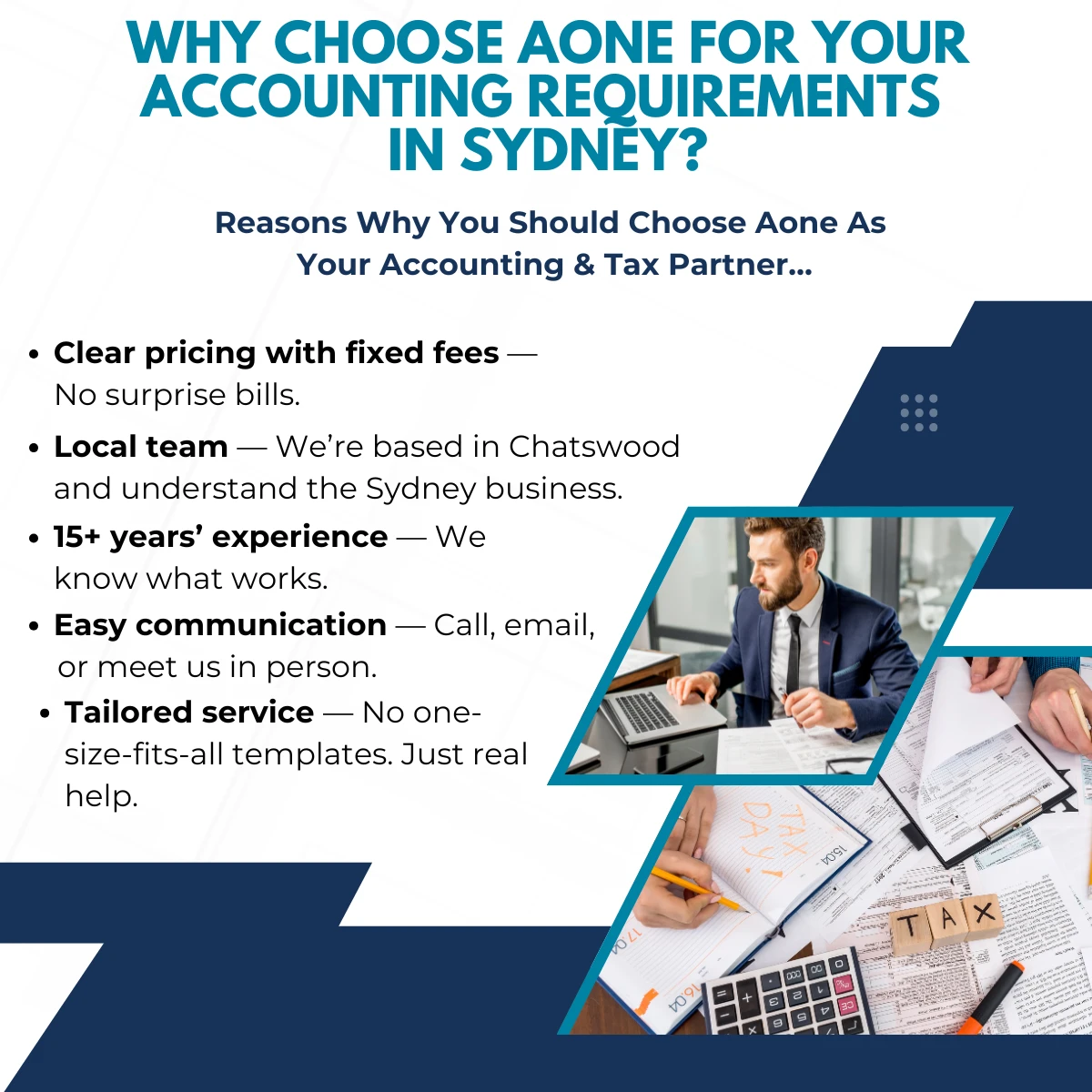

At A One, we offer easy-to-understand, professional accounting services Sydney and tax services for individuals, businesses, and professionals across Sydney. We know that every business is different. That’s why we take a personal approach to every client we work with, offering the right advice based on your industry, your business goals, and your financial situation.

Whether you’re in Chatswood, Parramatta, Bondi, the Inner West, or the North Shore, our Sydney-based team is here to help. We offer face-to-face support if you prefer to meet, and we also provide online accounting service Sydney if you want to manage things remotely.

With over 30 years of experience, we understand the local market and the problems businesses face. Our goal is to make your accounting simple, reliable, and stress-free.

Every business, individual, and profession has its own set of financial challenges, and we tailor our solutions to meet those exact needs. Whether you are a startup in Sydney, a doctor in private practice, or an investor, we have expertise to support you. Here are the services we offer in Sydney:

Bookkeeping is more than just tracking expenses, it’s the bedrock of sound financial management. Our outsourced bookkeeping services Sydney help businesses simplify their processes, stay compliant, and scale smoothly.

Our bookkeeping services include:

Daily/weekly/monthly reconciliation and reporting

Online bookkeeping service Sydney using Xero, MYOB, and QuickBooks

Outsource bookkeeping Sydney solutions for growing businesses

Affordable fixed packages for small business bookkeeping Sydney

Payroll & super management

Whether you're looking for bookkeeping online Sydney or outsourced bookkeeping Sydney, we’ll ensure your records are precise and always up-to-date.

Good accounting drives good business decisions. Our local accounting Sydney experts provide deep insights and clarity with:

General ledger and trial balance management

Budgeting and forecasting

Setup and migration to accounting software Sydney (Xero, QuickBooks)

Financial statements & board reports

Outsource accounting solution Sydney for hassle-free compliance

Whether you need online accounting Sydney, bookkeeping and accounting Sydney, or full outsourced accounting services Sydney, we’re the trusted partner for results.

Australian tax law changes frequently. Whether you're lodging a tax return Sydney or need help with tax preparation Sydney, we’ll make sure your compliance is perfect and savings maximized.

We handle:

Individual & business tax returns

Online tax return filing Sydney

Outsource tax return Sydney options for convenience

Tax return outsourcing Sydney for professionals and SMEs

BAS/IAS lodgement, ATO representation

From BAS preparation Sydney to capital gains tax planning, Aone has you covered.

Getting your Business Activity Statement Sydney right can save you penalties and sleepless nights. Aone is your trusted BAS Agent Sydney offering:

Preparing BAS Sydney and monthly/quarterly lodgements

Expert review of GST and PAYG

BAS lodgment Sydney for sole traders, companies, and trusts

Ongoing BAS compliance Sydney and ATO correspondence

Our BAS accounting Sydney specialists ensure you’re never late or incorrect.

Avoid the stress of payroll errors with Aone’s full-suite payroll services Sydney. We help you manage everything from payslips to STP reporting, with solutions for:

Weekly, fortnightly, or monthly payroll

Superannuation processing

Outsourced payroll Sydney packages

Payroll tax and year-end reporting

Sydney businesses trust Aone for smooth, affordable payroll outsourcing Sydney solutions.

Our SMSF outsourcing Sydney team offers expert administration, compliance, and audits for your self-managed super fund.

We offer:

SMSF accounting Sydney and annual financials

Online SMSF audit Sydney services

SMSF compliance Sydney reports and strategies

Outsource SMSF administration Sydney for hassle-free processing

Whether you're setting up an SMSF or managing an existing one, we’ll keep you compliant.

We know accounting and tax can feel overwhelming, especially with everything else you’re juggling in your business. But with the right support, it doesn’t have to be.

At Aone, we make numbers simple, deadlines manageable, and financial decisions easier to understand. Whether you’re behind on your BAS, struggling with tax planning, or just tired of managing it all alone, we’re here to help. Our Sydney-based team is friendly, experienced, and ready to guide you with honesty, clarity, and care.

No more confusion. No more last-minute panic. Just expert advice, full support, and the freedom to focus on your business while we handle the rest.

Reach out to us today for a free consultation. We’ll listen to your needs, explain how we can help, and give you a clear action plan. You must need a one-month free trial…

Sydney accountants typically charge between $150 $300 for individual tax returns, and anywhere from $80 to $200+ per hour for business services. At A One, we offer affordable, fixed-fee packages for individuals, businesses and sole traders in Sydney.

The “best” tax accountant depends on your needs. If you're looking for friendly service, deep experience, and reliable tax support tailored to Sydney clients, A One Accountants is a top-rated choice with over 30 years of local experience.

You can get your tax return completed at our Chatswood office or via phone/online appointments. A One specialises in simple and complex tax returns for Sydney residents, contractors, expats, and small businesses.

Yes, having a local Sydney accountant ensures you stay compliant with ATO rules, manage GST, lodge BAS correctly, and keep your cash flow in check. A One provides tailored support for Sydney small businesses, including trades, tech, health, and retail.

Look for qualifications (CPA, registered tax agent), local experience, transparent pricing, and industry knowledge. A One offers face-to-face and remote accounting services in Sydney with packages for every budget.

The tax year in Australia ends on June 30. Most individuals in Sydney lodge between July and October. If you use a registered tax agent like A One, you may qualify for an extended deadline.

Yes. If you've missed a BAS deadline or are behind on lodgements, A One can help you catch up quickly, deal with ATO notices, and prevent penalties.

A local Sydney accountant like Aone gives you the best of both worlds, personal face-to-face support and cloud-based services. You can meet in Chatswood or manage everything online. It’s flexible, reliable, and tailored to your needs.

Special characters are not allowed.