GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

The Australian market is so competitive now that no business can afford to waste money. Maintaining the proper flow of cash in a business depends greatly on Accounts Payable (AP) and Accounts Receivable (AR) services. Effective cash flow for a small business in Melbourne or a growing technology firm in Sydney depends on managing all your payments and receivables.

When these main financial functions aren’t working, businesses have difficulty like no payments to suppliers can strain their relationship with vendors, and weak management of receivables might cause shortages in earnings and damage customer trust. The main function of AP and AR services is to support your organisation’s entire working capital cycle.

When AP and AR are streamlined, using automation or outsourced expertise, modern businesses gain better financial insight and prepare for ongoing development. Let’s see how using these services can improve how we manage our money and the outcomes of our company.

Management of a company’s accounts with suppliers or creditors is referred to as Accounts Payable (AP). This work involves documenting, keeping a record of and paying for the goods and AP services the company receives. When an AP process is efficient, companies prevent late fees, keep their suppliers happy and qualify for discounts on early payments.

By contrast, Accounts Receivable (AR) is set up to manage the money owed to a company by its clients or customers. It includes issuing invoices, keeping track of payments that are past due and working on getting their payment on time. When AR is well-managed, it supports your cash flow, prevents many bad debts and maintains good relationships with customers.

AP and AR are important parts of a company’s financial system. Because of AP, expenditures are monitored and matches and AR sends money into the company to meet its needs and plans for the future.

Using these services correctly allows a company to see how healthy they are financially. With integration, companies can plan ahead, use their money wisely and keep cash shortage low. Outsourcers offer Australian companies a way to get their accounts payable and receivable in order without spending a lot of money.

Keeping accounts payable under control boosts the business's steady survival and continued success. Find out how AP services make a difference for your business:

1. Enhance Management of Your Company’s Cash Flow: An efficient AP process helps ensure payments leave when they’re supposed to—not so quickly that it hurts your liquidity and not so late that you get charged penalties. Good timing in business can improve how you predict cash flow and keep your working capital safe during uncertain times.

2. Build Better Vendor Relations: If businesses make timely payments, suppliers become more likely to form a lasting partnership that might bring future negotiating benefits. With reliable payments, businesses can get access to products sooner, more favourable credits and better discounts which helps soothe their supply chain and increase efficiency.

3. Minimise the Chance of Errors and Fraud:- By automating AP, companies avoid entering information by hand, which minimises the risk of paying twice, using the wrong amounts or falling victim to fraud. Because of the audit trail and multistep approval process, businesses can correctly handle their finances and meet all the required standards.

4. Operational Efficiency should be improved:- Businesses that outsource AP to professionals like AONE can work more efficiently. With this in place, internal finance teams can work on important duties such as making a budget and reviewing results, instead of wasting time on things like invoices.

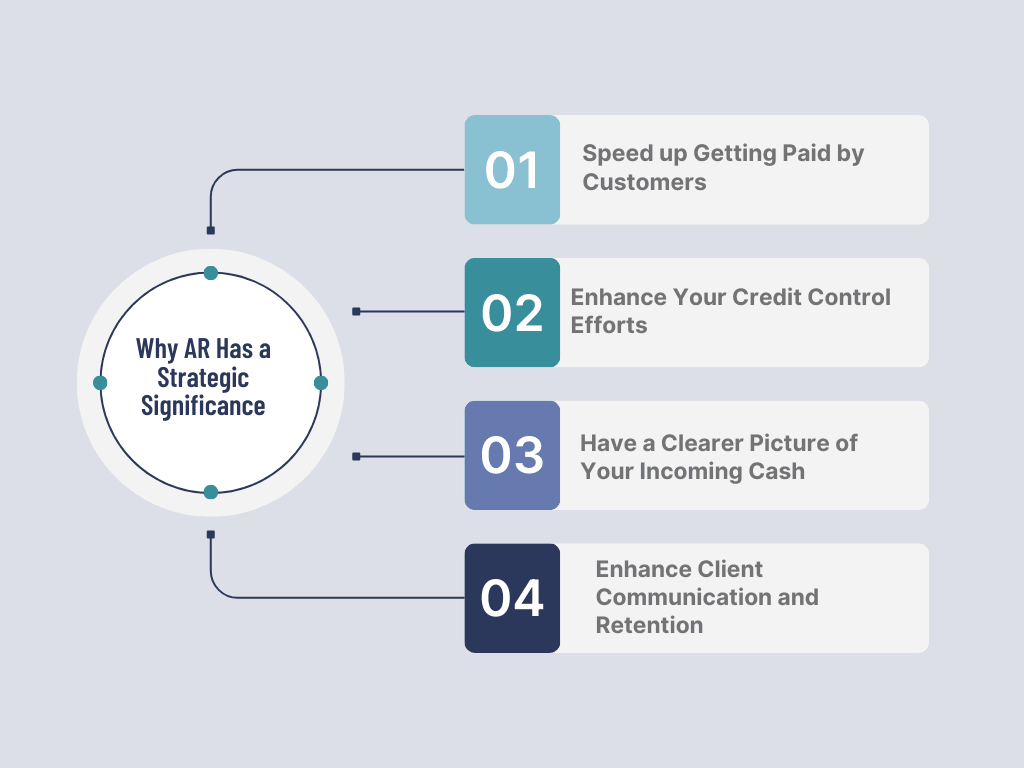

Making sure there is a steady source of cash comes from relying on Accounts Receivable. If managed correctly, account receivable solutions boosts your company’s capability to adapt to changes and improve how you care for customers.

1. Speed up Getting Paid by Customers: Automated AR reduces the time it takes to bill, so customers receive their invoices and reminders quickly and can pay faster. As a result, cash storage days are cut, which helps the company bring back invested funds to the business quicker.

2. Enhance Your Credit Control Efforts: Checking credit status and defining payment terms helps manage and reduce the danger of unpaid debts. AR experts hired from outside your organisation can review your customers’ payments and recommend steps to avoid turning them into bad debt risks.

3. Have a Clearer Picture of Your Incoming Cash: Increased use of AR allows businesses to see the status of invoices and predict their future inflows of cash more accurately. Managing these important aspects helps companies that receive cash at cyclical times.

4. Enhance Client Communication and Retention: Keeping invoices clear, allowing different ways to pay and being polite when following up with clients helps you appear professional and trustworthy. If service companies in Australia can create a positive billing process, they often receive more satisfaction, stronger loyalty and word-of-mouth recommendations.

With a major move to digital work, Australian businesses are relying on Xero, MYOB and NetSuite for their complex financial management, making their financial processes correct and speedy. Such systems are key to the modernisation of the AP and AR processing.

Real-Time Financial Reporting System: Using automation, corporations can monitor their debts and invoices instantly, understanding their current cash situation. With such data, you can handle finances efficiently and be responsive to sudden changes in revenue, very important in fields with close margins or changing revenue patterns.

Fewer Errors by People: Because automation requires less user involvement, it greatly decreases the chances of errors and duplicate or lost invoices. Validation checks are embedded into the system to keep everything consistent and correct, sparing the company from having to rework expensive projects.

Increased Ability to Handle Audits: Such systems record all dealt-with transactions, necessary approvals and communications by default. Thanks to this, your company’s financial trail is transparent and easy to search, allowing you to meet requirements and be prepared for an audit without having to scramble.

Giving the Right Resources to the Right Teams: If you automate tasks such as invoicing and data processing, employees can focus instead on important tasks such as creating budgets, forecasts or dealing with vendors. Moving toward strategic work from transactions can greatly improve how the business works.

Many Australian businesses now choose to outsource these activities to account payable and accounts receivable company, since it gives them flexibility, helps them save money and provides needed expertise without hiring more finance staff.

Cutting Cost Related to Running the Business: Hiring AONE Outsourcing for accounting, payroll and HR services means businesses save on staff hiring, new infrastructure and software expenses. It lowers expenses that never change and promotes better financial efficiency for SMEs and growing businesses.

The Ability to Work with Skilled Finance Specialists: AONE Outsourcing ensures you have experts in AP and AR processes on your team. This way, tasks are completed correctly and quickly, you don’t need to recruit, train or manage a group of workers.

Increased Scalability: With business growth, operations related to finances get more complex. Cloud-based services are able to expand easily as the business expands or takes on a multi-entity structure. Because of this flexibility, businesses can grow sustainably without facing problems during operations.

Improved Turnaround Time and Compliance: Using focused teams and structured processes, outsourcing partners are faster at managing both invoices and payments and ensuring compliance with needed rules. Your company will complete tasks on time, avoiding legal or financial penalties.

All in all, Accounts Payable and Accounts Receivable form the key to a robust and financially responsible company. AP and AR systems that are managed properly save you money and allow you to make smart business choices.

Interested in finding ways to handle your money easily and wisely?

Let AONE Outsourcing guide you through making your AP and AR processes smoother. The knowledge and experience of our team guarantee accuracy, speed and full view of your finances, so you can invest your energy into business growth.

If you’d like help achieving your financial goals, call us directly.

At Aone Outsourcing Solutions, we believe smart businesses don’t just manage their accounting; they streamline their accounting process. With years of experience supporting accounting firms and businesses across the UK, USA, Canada, Australia, and Ireland, our team knows how to turn everyday financial processes into strategic advantages.

From bookkeeping and payroll to tax preparation, accounts payable, and compliance, weve helped firms simplify their accounting workflows, cut operational costs, and maintain complete accuracy at every step.

Because at Aone, your accounting success is the goal we care about most.

Content on this website is shared for general awareness and educational purposes only. It should not be taken as financial, accounting, taxation, or legal advice. At Aone Outsourcing Solutions, we do our best to keep all information relevant and accurate; however, we can’t promise that every detail is up to date or fits every business situation. Because regulations and compliance requirements can change, we encourage you to seek guidance from an expert professional before acting on any information on this site. Aone Outsourcing Solutions will not be responsible for any decisions made or losses incurred based on the material published on this website. For advice specific to your business needs, please get in touch with our team .

Special characters are not allowed.