GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

The Australian accounting industry has changed significantly in recent years. With new technologies, tighter compliance rules, and rising client expectations, firms are now expected to deliver strategic advice while meeting strict lodgement deadlines and maintaining flawless compliance.

This shift hasn’t been easy. Skilled accountants are in short supply, hiring is competitive and costly, and maintaining in-house teams for repetitive tasks - bookkeeping, payroll, BAS, SMSF and tax returns - quickly reduces profit margins.

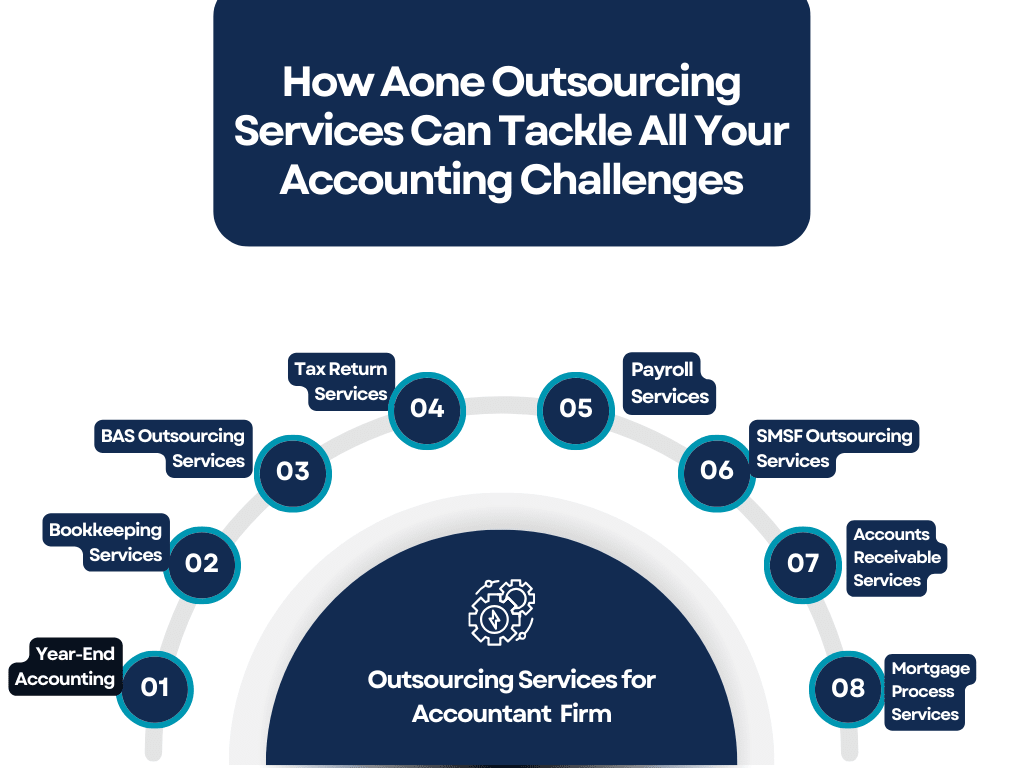

This is where Aone Outsourcing Solutions helps. With over 10 years’ experience supporting Australian accounting firms, we handle time-consuming tasks - from BAS lodgement and mortgage processing to SMSF administration - so you can focus on client relationships and growth. Our services are built to scale with your needs, reduce costs and deliver speed, accuracy and compliance.

With Aone as your back-office partner, you can finally break free from the never-ending admin cycle and put your energy into growing client relationships and revenue.

With a skilled global team, advanced accounting software, and proven workflows, we help you reduce costs, improve accuracy, and free up your time to focus on growing your business.

Whether you need end-to-end accounting, mortgage processing, payroll management, or specialised compliance support, we tailor our services to fit your exact accounting requirements.

Challenges of Mortgage Processing Services

Mortgage is a process that is the most detail-intensive and compliance-sensitive workflow in the finance industry. Accounting practices that deal with mortgage brokers, property investors or small business clients are engaged in the processing of plenty of paperwork, confirming information about its customers, communicating with financial institutions and observing the requirements of the Australian Prudential Regulation Authority. Failure or delay of this process may run clients out of their financing opportunities.

How Aone Mortgage Outsourcing Services Can Help

Our mortgage outsourcing team manages application review, credit assessment, document verification, settlement scheduling and post-settlement compliance. With expertise in Australian lending processes and secure cloud-based systems, we ensure applications move faster, with higher precision and full data security. How can we benefit your firm:

Faster Loan Turnaround: Clients get their approvals quicker, improving satisfaction and trust.

Reduced In-House Pressure: Your staff can focus on advisory and client relationship management instead of paperwork.

Error-Free Compliance: Every document is cross-checked to ensure it meets lender and regulatory standards.

|

Pro Tip: By outsourcing mortgage processing to Aone, accounting firms can offer value-added service to their existing client base, opening up new revenue streams without hiring specialised mortgage staff. |

Challenges of Accounts Receivable Services

Late payments or missed payments with your clients can affect your business operation smoothly. For accounting firms managing AR for multiple clients, chasing invoices, sending reminders, and reconciling accounts can drain on resources, especially during peak reporting seasons. Ineffective AR management can also strain client relationships if follow-ups aren’t handled with professionalism.

How Aone Accounts Receivable Services Can Help

Our services also include the end-to-end management of AR, such as preparation of invoices, automated payment reminders, follow-up calls to debtors, and escalation of overdue accounts processes. Our group is easily connected to Xero, MYOB and QuickBooks, so that you and your clients can see real-time receiving activity. you will receive:

Better Collection Rates: Quicker payments imply better cash flow to your clients.

Client Retention Enhancement: Offering AR management will enhance your firm's reputation as a partner that delivers results.

Stable Processes: We have professional collection protocols that safeguard client relationships.

|

Pro Tip: Accounts receivable “cash flow health check” service package can be a powerful upsell for small business clients who struggle with late payments. |

Challenges of SMSF Services

Managing Self-Managed Superannuation Funds in Australia is a specialised field. The ATO enforces strict compliance rules covering everything from member contributions to pension payments, investment restrictions, and annual reporting. Even minor errors in SMSF administration can lead to penalties and compliance breaches.

How Aone SMSF Services Can Help

Our SMSF outsourcing team handles financial statement preparation, member benefit calculations, annual returns, investment compliance checks, and audit support. We stay up-to-date with superannuation law changes so your firm can be confident that every SMSF under your management is fully compliant.

Benefits to Your Firm:

Reduced Compliance Risk: Every report is prepared in line with ATO requirements.

Time Savings: Free up senior accountants for client advisory and strategic work.

Cost Efficiency: Avoid the high salary costs of in-house SMSF specialists.

Challenges of Payroll Services

Payroll might seem straightforward, but for Australian accounting firms, it’s a compliance minefield. Every pay run involves award interpretation, superannuation contributions, PAYG withholding, leave accruals, and now Single Touch Payroll, Phase 2 reporting. Any error whether underpaying an employee or missing a reporting deadline can lead to Fair Work investigations, ATO penalties, and damaged client trust.

How Aone Payroll Services Can Help

Aone offers end-to-end payroll outsourcing tailored to Australian compliance requirements. We manage:

Timesheet collection and validation

Gross-to-net salary calculations

Award and EBA compliance checks

Superannuation processing and reporting

STP Phase 2 reporting to the ATO

Payslip distribution and year-end payment summaries

We integrate directly with payroll software like Xero Payroll, MYOB, KeyPay, and QuickBooks Payroll, ensuring real-time data updates and error-free reporting.

|

Pro Tip: Offer payroll outsourcing as a bundled service with BAS preparation—it’s a natural pairing that strengthens client retention. |

Challenges of Tax Return Services

Preparing tax returns has become more complex with frequent ATO changes in deductions and corporate tax rules. Businesses must be extra cautious to avoid mistakes or missed claims. The busy period from July to October makes it harder, as firms face heavy workloads and tight deadlines. For smaller firms, this often means late nights, overworked teams, and sometimes turning away clients because they can’t manage the volume.

How Aone Tax Return Services Can Help

Our tax outsourcing services cover individual, partnership, trust, company, and SMSF returns. You can get benefits to your firm:

Faster Turnaround: Take on more clients during peak season.

Reduced Error Rates: Every return is double-checked for compliance and accuracy.

Capacity Expansion: Handle overflow work without hiring seasonal staff.

|

Pro Tip: Promote “fast, compliant tax return preparation” as a competitive differentiator; many clients will pay a premium for guaranteed lodgment before deadlines. |

Challenges of BAS Services

BAS lodgment is one of the most common compliance tasks for Australian businesses, but for accounting firms managing multiple clients, the quarterly deadlines can be overwhelming. Errors in GST reporting, PAYG withholding, or fuel tax credits can trigger ATO audits. Plus, every late lodgment means penalties and unhappy clients.

How Aone BAS Services Can Help

We provide complete BAS preparation and lodgment support:

GST and PAYG calculations based on accurate bookkeeping data

Reconciliation checks to ensure figures match financial records

Draft BAS preparation for your review

Electronic lodgment via your firm’s ATO portal

On-Time Lodgment Guarantee: No more last-minute rushes.

Accuracy Assurance: Reduce the risk of ATO penalties and audits.

Workflow Relief: Free up staff during peak BAS months.

|

Pro Tip: Use your 100% BAS compliance record as a marketing tool, it’s a strong selling point for attracting new clients. |

Challenges of Bookkeeping Services

Bookkeeping is the backbone of every accounting function. Without accurate, up-to-date books, tax returns, BAS statements, and financial reports are prone to errors. But maintaining clean books is time-consuming and often eats into capacity for higher-margin advisory services. Many firms also face difficulties finding reliable junior staff to handle repetitive bookkeeping tasks.

How Aone Bookkeeping Services Can Help

We provide daily, weekly, or monthly bookkeeping services using your clients’ preferred software Xero, MYOB, QuickBooks, Sage, or others. Our work includes:

Consistent Data Quality: Always have accurate books ready for review.

Cost Savings: Avoid the overhead of in-house bookkeepers.

Flexibility: Scale your services up or down according to your client's needs.

|

Pro Tip: Sell bookkeeping outsourcing as a growth enabler when your firm isn’t bogged down in data entry, you can handle more clients without extra hires. |

Challenges of Year-End Accounting Services

Year-end accounting is one of the most stressful times for firms. Every ledger must be reconciled, adjustments posted, depreciation calculated, and final financial statements prepared. If bookkeeping hasn’t been maintained perfectly throughout the year, this process becomes even more labour-intensive. Clients expect fast turnaround, but internal staff often face long hours to deliver.

How Aone Year-End Accounting Services Can Help

Faster Report Delivery: Meet client and compliance deadlines without overtime.

Error-Free Statements: Reduce the risk of post-filing corrections.

Team Relief: Free your senior accountants for advisory and tax planning.

Australian accounting firms face constant pressure from ATO deadlines, staff shortages, and rising costs. Aone Outsourcing Solutions steps in as a trusted partner to ease these challenges and help firms focus on growth.

Here’s why firms choose us:

Local Compliance Expertise: In-depth knowledge of Australian BAS, SMSF, payroll, and tax requirements.

Scalable Support: Extra hands during peak tax season or year-end crunch without long-term hiring costs.

Cost Efficiency: Reduce overheads by outsourcing repetitive tasks like bookkeeping, AP/AR, and payroll.

Accuracy & Speed: Dedicated teams ensure deadlines are never missed and compliance stays intact.

Advisory Focus: Free up in-house staff to build stronger client relationships and deliver strategic advice.

With Aone, you get outsourcing services, but a partner committed to efficiency, compliance, and long-term success.

The accounting landscape in Australia is changing rapidly, with firms under pressure to deliver more value while keeping costs under control. Partnering with Aone Outsourcing Solutions allows firms to offload time-consuming back-office functions and focus on what truly matters building client relationships, offering high-value advisory services, and scaling profitably.

Aone provides a comprehensive range of outsourcing services to Australian accounting firms covering mortgage processing, BAS, SMSF, payroll, bookkeeping, tax returns, AR/AP and year-end compliance. Our expertise in local compliance requirements-based on our in-depth knowledge, coupled with an effective offshore delivery model will help your firm to be always ahead of schedule and of client demands.

Whether you’re a small practice looking to ease workload or a mid-to-large firm aiming to scale without ballooning costs, Aone can be the strategic partner you need to transform operations.

With over a decade of experience in the Australian market, Aone combines global expertise with deep local compliance knowledge. From BAS and SMSF to payroll and mortgage processing, our team ensures accuracy, speed, and 100% compliance while acting as a true extension of your firm.

Yes. Aone uses secure, cloud-based systems and follows strict confidentiality protocols to ensure data safety. We also give firms full visibility of workflows, so you stay in control at every step.

Absolutely. Our flexible model lets you scale support up or down depending on workload. Whether it’s July-October tax season or quarterly BAS crunch time, you’ll never have to turn away clients due to lack of capacity.

Outsourcing strengthens relationships by giving firms more time to provide strategic advice and personalized service. Aone handles the time-consuming compliance work, so you can focus on building trust.

We integrate seamlessly with popular platforms like Xero, MYOB, QuickBooks, Sage, and KeyPay, ensuring smooth collaboration and real-time data updates.

At Aone Outsourcing Solutions, we believe smart businesses don’t just manage their accounting; they streamline their accounting process. With years of experience supporting accounting firms and businesses across the UK, USA, Canada, Australia, and Ireland, our team knows how to turn everyday financial processes into strategic advantages.

From bookkeeping and payroll to tax preparation, accounts payable, and compliance, weve helped firms simplify their accounting workflows, cut operational costs, and maintain complete accuracy at every step.

Because at Aone, your accounting success is the goal we care about most.

Content on this website is shared for general awareness and educational purposes only. It should not be taken as financial, accounting, taxation, or legal advice. At Aone Outsourcing Solutions, we do our best to keep all information relevant and accurate; however, we can’t promise that every detail is up to date or fits every business situation. Because regulations and compliance requirements can change, we encourage you to seek guidance from an expert professional before acting on any information on this site. Aone Outsourcing Solutions will not be responsible for any decisions made or losses incurred based on the material published on this website. For advice specific to your business needs, please get in touch with our team .

Special characters are not allowed.