GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

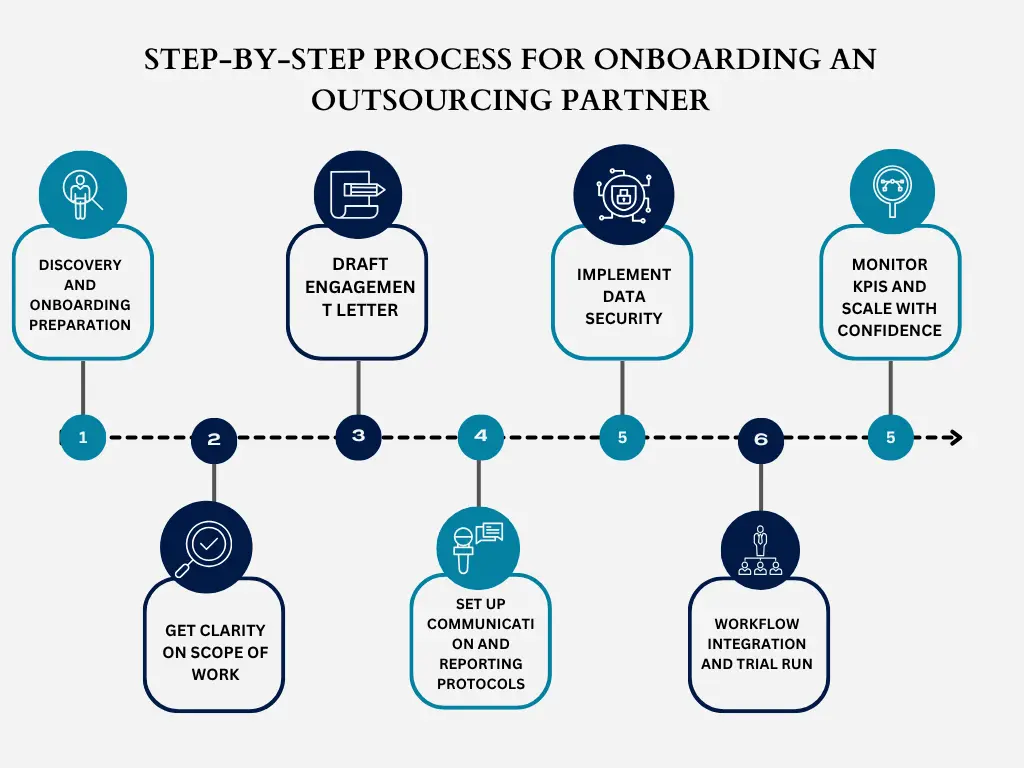

Outsourcing in the accounting industry is no longer just about cutting costs, it’s about scaling smartly, accessing specialised expertise, and creating operational bandwidth. But here’s what many firms overlook: a well-structured onboarding process is what determines whether your outsourcing partnership succeeds or stalls.

If you're an accounting or CPA firm planning to outsource services like bookkeeping, AP/AR, tax preparation, or payroll, onboarding is the first real test. It’s where you align expectations, integrate workflows, and ensure that your outsourced team understands not just the tasks but also your firm’s standards, clients, and compliance protocols.

The success of outsourcing depends entirely on how well you onboard your partner.

Without a defined onboarding process, even the most skilled outsourcing provider can fall short of your expectations. That’s why this blog walks you through the complete accounting firm outsourcing setup steps, including timelines, protocols, documentation, and performance indicators.

Throughout, we’ll also show you how Aone Outsourcing Solutions supports accounting firms globally with structured, secure, and scalable onboarding processes so you get results from day one.

If you want to jump into contract or task assignment, first warrant a structured discovery process when it comes to outsourced accounting. This is where you go and specify exactly what you require and determine how the outsourcing firm is fitted to supply it.

The main activities of this stage:

Set out your pain points and outsourcing objectives at your network firm

Identify which processes to delegate: bookkeeping, tax prep, AP/AR, payroll, etc.

Map your existing software stack (Xero, QuickBooks, Sage, etc.)

Gather SOPs, sample reports, and internal documentation

Vet the outsourcing provider’s credentials and compliance policies

Why Choose Aone?

At Aone Outsourcing Solutions, we begin every engagement with a discovery call tailored to your firm’s structure, goals, and challenges. Our team walks you through our approach, shares case studies, and helps you shortlist the exact services best suited for outsourcing.

Outsourcing transition timeline accounting: This phase typically takes 3–5 business days.

After a decision is made on what to outsource, write down the scope. This will make sure both your internal staff and your outsourced provider knows the same thing, assumptions are eliminated and we have no grey areas.

Include the following:

Task list (daily, weekly, monthly)

Tools/software to be used

File-sharing access and workflow systems

Escalation matrix

Timelines and expected turnaround

Back-up or support structure for seasonal load

Why Choose Aone?

We co-create a detailed scope document with your team, outlining responsibilities down to each deliverable. You don’t get a generic setup, you get custom workflows, aligned to your practice and client needs.

Defining scope and responsibilities is one of the most important steps in successful outsourcing partnerships.

Every professional relationship needs a foundation, and in outsourcing, that comes in the form of a solid Engagement Letter and Service Level Agreement (SLA).

These legal and operational documents define:

Start date, duration, and termination clauses

Data protection and confidentiality

Turnaround time (TAT) expectations

Volume commitments

Error thresholds and rectification process

Payment terms and billing cycles

Our legal and compliance team works closely with your firm to draft engagement documents that are legally sound and locally compliant. From NDAs to SLAs, everything is customisable based on your practice model and country-specific privacy laws.

It is here that a lot of companies fail. They presume that the outsourced unit will figure it out. Rather, establish specific guidelines on:

Daily check-in or weekly alignment

TMS (Asana,ClickUp,etc.)

Communication tools ( Slack, Teams, Zoom )

Updates and status monitoring in real time

Formats of reports and timelines of delivery

What Aone Does Differently:

We integrate directly into your preferred tools and time zones. Want a 9 AM sync every Monday? You’ll have a dedicated team lead from Aone ready. Want task tracking through Trello or ClickUp? Done. Our communication playbook is built to reduce lag, not add to it.

Creating communication protocols with an outsourced bookkeeping partner is equal to higher accountability.

Data in accounting is confidential. This is the reason why security policies on onboarding during accounting outsourcing are not negotiable.

Key areas to consider:

Client files are password-protected.

Work in safe cloud settings (e.g., Google drive, SharePoint)

Accounting software access control Role

Two-factor authentication

VPNs, or dedicated IP access

Data security is one of the pillars of Aone Outsourcing Solutions. Our practices are GDPR, SOC 2 and ISO/IEC 27001-compliant. Your client data is never accessed outside of safe virtual environments and geo-restricted access can also be provided.

Now it’s time to go from planning to practice. Start with a trial phase or pilot project to assess compatibility and iron out any issues.

Here’s what to test:

Workflow clarity and task management

File handoffs and documentation

Turnaround time accuracy

Response time and escalation management

Internal feedback process

We encourage every new client to start with a 2–4 week onboarding trial, with full task tracking and performance metrics. This helps you build confidence and gives us time to align closely with your expectations before scaling up.

How long does it take to onboard an outsourced accounting partner? With Aone: 2–4 weeks on average.

Once the trial is successful, move to full-scale onboarding. But remember, onboarding doesn’t stop after the first few weeks. Continual improvement is key.

Set up quarterly performance reviews to monitor:

Turnaround time

Accuracy rates

Communication quality

Proactive issue handling

Client satisfaction (indirectly through your internal team feedback)

We provide a dedicated account manager to your firm, someone who monitors performance KPIs, shares reports, and leads optimisation strategies. We grow with your firm, scaling services as needed during tax season or year-end crunches.

Performance KPIs for the outsourcing partner should be realistic, measurable, and continuously reviewed.

Outsourcing in the accounting industry isn’t plug-and-play. It’s a strategic move that requires structure, planning, collaboration, and most importantly, the right onboarding process.

Each of the steps, beginning with the discovery call through to documentation of the processes, security requirements, and KPI synchronization, is critical in creating long-term success with your outsourced partner. Such a process cannot be rushed as it causes a lack of communication, noncompliance, and poor outcomes.

At Aone Outsourcing Solutions, we also understand that onboarding is not only the the transfer of files and checklist items marked. It is about developing a work pace that suits the objectives, schedules, and customers of your firm as well as your regulatory structures.

Here’s why accounting firms across the US, UK, Canada, Ireland, and Australia choose us as their onboarding and outsourcing partner:

Zero-downtime onboarding: We set up parallel processes and pilot tests to avoid disruptions to your client work.

Dedicated onboarding managers: You’ll have a single point of contact to guide you through our well-structured integration process.

Tailored SOPs & documentation support: We help you formalise your workflows for offshore teams, so nothing is lost in translation.

Secure and compliant infrastructure: Your data stays protected with industry-grade access controls, encryption, and audit trails.

Transparent reporting & communication protocols: Weekly check-ins, monthly performance reviews, and a system that works in your time zone.

Whether you’re outsourcing bookkeeping, tax return prep, AP/AR, or payroll, we ensure that you get off to the right start.

At Aone Outsourcing Solutions, we believe smart businesses don’t just manage their accounting; they streamline their accounting process. With years of experience supporting accounting firms and businesses across the UK, USA, Canada, Australia, and Ireland, our team knows how to turn everyday financial processes into strategic advantages.

From bookkeeping and payroll to tax preparation, accounts payable, and compliance, weve helped firms simplify their accounting workflows, cut operational costs, and maintain complete accuracy at every step.

Because at Aone, your accounting success is the goal we care about most.

Content on this website is shared for general awareness and educational purposes only. It should not be taken as financial, accounting, taxation, or legal advice. At Aone Outsourcing Solutions, we do our best to keep all information relevant and accurate; however, we can’t promise that every detail is up to date or fits every business situation. Because regulations and compliance requirements can change, we encourage you to seek guidance from an expert professional before acting on any information on this site. Aone Outsourcing Solutions will not be responsible for any decisions made or losses incurred based on the material published on this website. For advice specific to your business needs, please get in touch with our team .

Special characters are not allowed.