GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

Managing an increased Self-Managed Super Fund (SMSF) is a complex task that requires a deep understanding of compliance and reporting conditions under ever-changing regulations. For Australian accounting firms and financial advisors, this complexity has only increased, complicating the management of services, tax regulations, investment benchmarks, and audit schedules, creating a web of challenges.

As the Australian Taxation Office (ATO) intensifies its pressure on companies to comply, firms are considering diversifying their approaches to compliance in more sophisticated ways. In this case, SMSF outsourcing services provide not only a solution but also a strategic advantage. Through arrangements with SMSF service providers, the firms can outsource their administrative and accounting burdens, which are often time-consuming, to those with the expertise and knowledge of the complex compliance requirements.

Starting with handling daily transactions to preparing end-of-year reports, SMSF accounting services ensure that ATO requirements accurately reflect the activities of funds. Besides increasing the efficiency of operations, outsourcing also ensures that firms and their clients are audit-ready, thus minimising the likelihood of penalties and ensuring compliance.

The ATO maintains a detailed checklist regarding the obligation program for SMSF trustees or administrators, ensuring that funds are charged by superannuation laws. These duties are:

Lodgment of annual tax returns: All SMSFs are required to lodge an annual tax return, which includes details of income, member contributions, member balances, and regulatory compliance.

Member contribution limits: It is necessary to monitor concessional and non-concessional contributions to prevent excess contribution penalties.

Investment compliance: SMSFs must comply with the provisions related to transactions with related parties, the sole purpose test, and the valuation of their assets.

Declarations as a trustee and record-keeping: Trustees will be required to make declarations as expressed and retain all relevant records for a minimum of five years.

Annual independent audit: Before lodging an annual SMSF return, each SMSF must be audited by an approved SMSF auditor.

Non-compliance with ATO obligations can result in severe consequences, including financial penalties, refusal of funds, or even the removal of trusteeship. Given the volume and detail of ATO requirements, outsourcing is an efficient way to ensure compliance without sacrificing quality. The benefits of outsourcing to expert companies include streamlined operations, minimal error rates, and accurate reporting and documentation.

Due to the competitive environment in the financial market today, SMSF outsourcing is becoming common among Australian accounting firms and financial advisors who need to cope with the increasing regulatory requirements without creating unnecessary workloads in their offices. Outsourcing to reliable professionals has quantifiable, evident benefits as compared to mere cost reduction.

The laws of superannuation are complex and frequently updated. Outsourcing means that specialists in the SMSF service industry professionally manage your client's funds. These professionals stay up-to-date with laws and ATO developments, ensuring that all reports and transactions are handled correctly and by the law. Companies that utilise SMSF outsourcing services benefit from fewer inaccuracies, prompt submissions, and a reduced risk of incurring penalties, which provides a sense of security and confidence in the service.

It may be costly to sustain a full-time internal staff to handle SMSF work, particularly when considering the costs of training, software, and quality assurance. All those overheads are absent in outsourcing, and efficiency is enhanced. With our SMSF accounting services, we undertake the bookkeeping, reconciliation, and reporting tasks, relieving your internal resources to focus on other, more critical and strategic tasks.

Outsourcing is a way of removing administrative and technical requirements from your employees' shoulders, thus freeing your company to offer high-value services to clients. Advisors have more time to consult on investment strategies, retirement planning, and compliance activities, which in turn enhance client relationships and drive business growth.

Finally, by outsourcing SMSF, companies can expand their SMSF portfolio without jeopardising compliance, quality or client satisfaction.

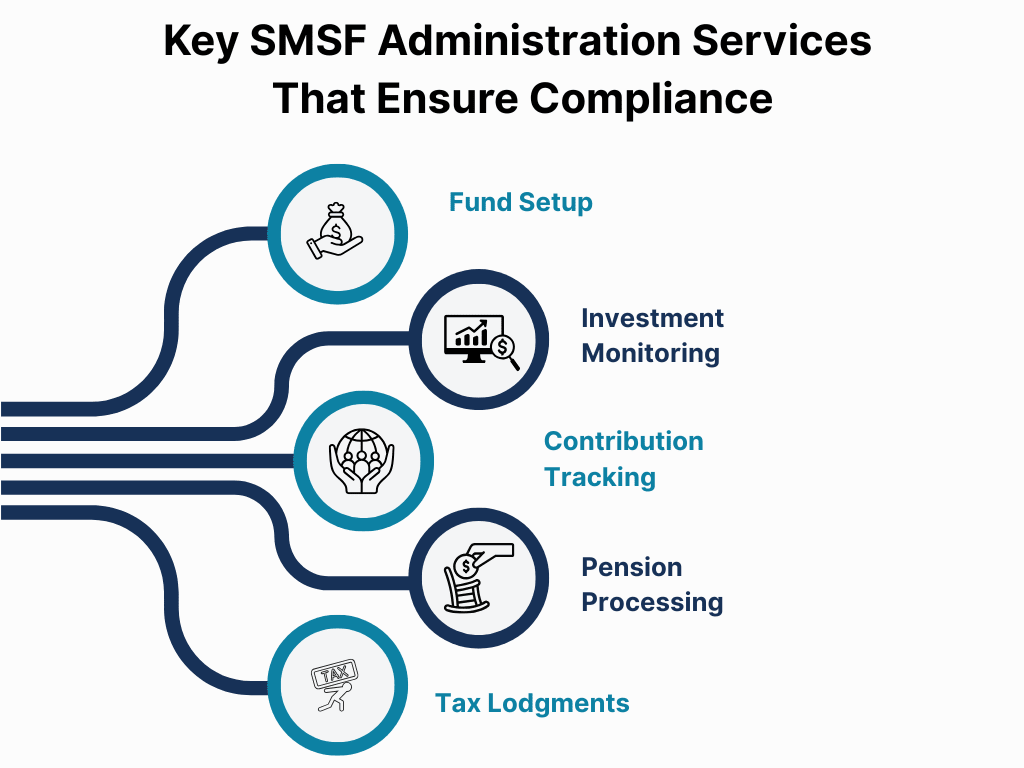

To become ATO compliant, appropriate accounting is not enough; only with strong and continuous administrative support is it possible to ensure that all aspects of an SMSF are accurately recorded, tracked, and reported. SMSF administration service providers are reputable companies that offer a range of solutions to ensure complete compliance with the ATO, enabling firms to deliver value to their clients regularly. The following are the primary administrative duties that outsourced SMSF service experts handle:

1. Fund Setup: Outsourcing companies deal with the full setup processes of new SMSFs, such as the preparation of trust deeds, registration of ABN and TFN, and declaration of trustee. This makes the fund legal on the first day.

2. Investment Monitoring: Frequent audits help ensure that the fund's investment activities comply with the rules of the ATO, including aspects of diversification, asset separation, and transactions between related parties.

3. Contribution Tracking: Contribution caps, on the other hand, are constantly changing; therefore, careful tracking is necessary. Contributions are monitored in real time through the outsourcing providers, meaning that when there is a risk of excess contributions, it is flagged and adherence to super laws is ensured.

4. Pension Processing: SMSF providers would also help set up and ensure that the pensions are managed, determining the minimum draws and lodging the required documents with the ATO to maintain the funds in a compliant position during the pension phase.

5. Tax Lodgments: One of the most important things is to prepare and file the tax requirements of Australia in a timely and perfect manner. The outsourced teams also ensure that annual returns, regulatory statements, and any other mandatory forms are filled out correctly and on time.

Outsourcing such crucial SMSF administration services means that the firms involved can drastically reduce the costs of administration-related errors, demanding turnaround times, and ATO compliance on an ongoing basis, keeping clients of the firm audit-ready year after year, while safeguarding their retirement savings.

In Australia, any Self-Managed Super Fund (SMSF) is required to undergo an annual independent audit, as mandated by law for the fund. The audit process is technical and, in most cases, time-consuming for most firms. Outsourcing services companies, which offer SMSF audit online, simplify and expedite the process, enabling funds to be in audit mode at all times.

Recent outsourcing companies have done even better, providing cloud-enabled platforms that essentially make the fund data centricised so that it is accessible at any time of the day and night. This has enabled not only the smooth cooperation between accountants, auditors and trustees, but it also makes the audit process transparent and traceable.

SMSF audit services can also monitor the audit process in real-time through intelligent dashboards and automated workflows. Firms are notified about any documentation that is not completed, compliance issues, or the risk of ATO loss or deadline, so these issues can be resolved before the company experiences delays.

Outsourced SMSF professionals are familiar with the latest audit principles, and the ATO's requirements require all reports, statements, and forms. These will include audit engagement letters, contravention reports (where applicable), and fully compliant financial statements.

With ASIC-certified auditors who are experienced in all stages of the audit lifecycle, including data review, assessment, and final certification, there is minimal exposure to compliance breaches and an increase in the accuracy of audit performance.

Utilising reliable online solutions for SMSF audit services enables firms to easily navigate their annual compliance challenges, fostering a good relationship among the firm, the client, and the regulator.

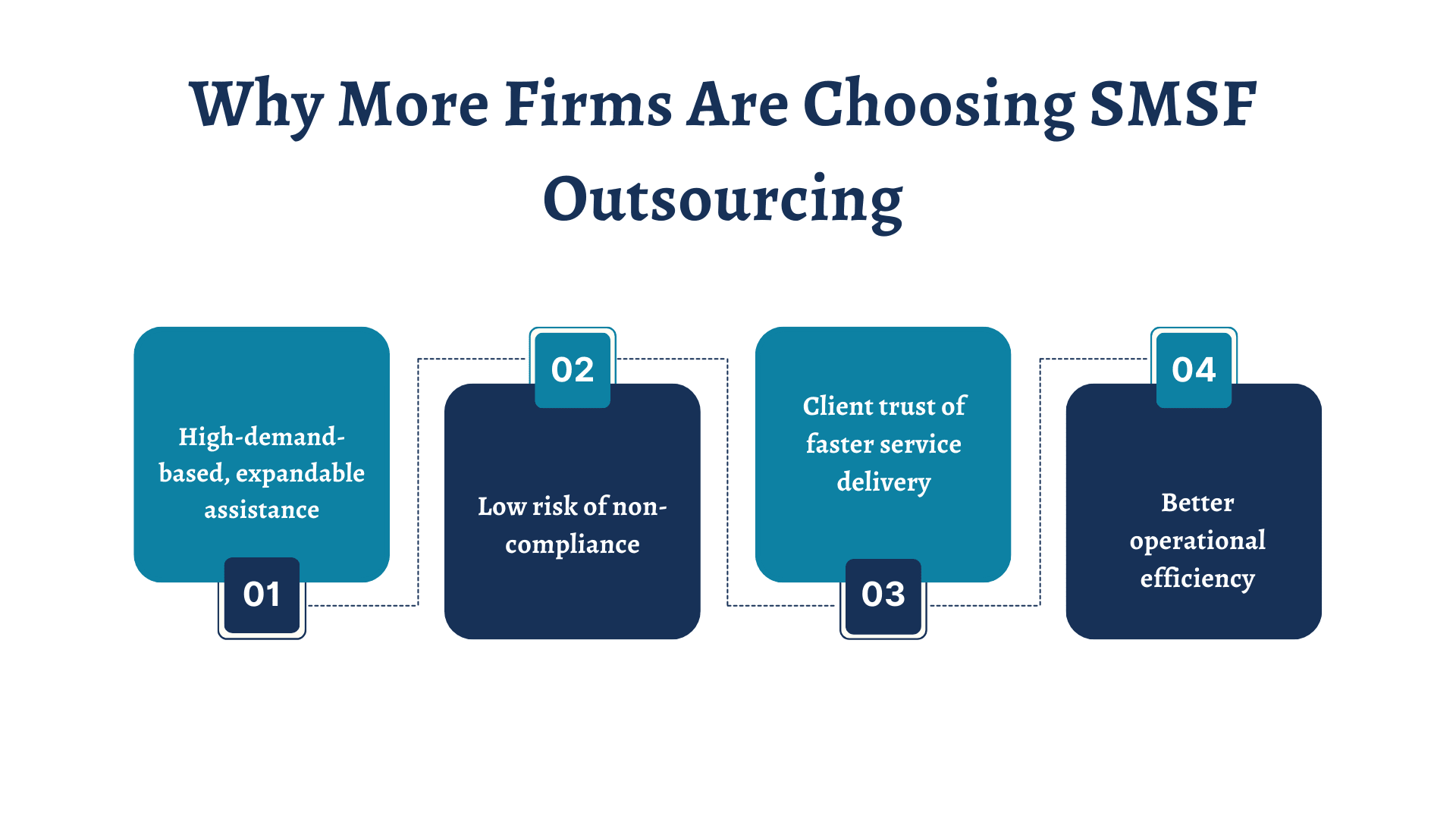

The increasing regulatory burden in the superannuation sector has driven most Australian companies to implement a long-term strategy, namely SMSF outsourcing. Here is why this change has become a competitive edge in the field of financial services:

The increasing regulatory burden in the superannuation sector has driven most Australian companies to implement a long-term strategy, namely SMSF outsourcing. Here is why this change has become a competitive edge in the field of financial services:

1. High-demand-based, expandable assistance: Outsourcing enables companies to maximise their operations at peak tax periods without hiring and training new in-house employees. This facilitates continuity and uniformity in the turnaround time regardless of the workload.

2. Low risk of non-compliance: Engaging experienced SMSF service specialists to partner with assures that all administrative, audit, and technical facets of compliance are handled accurately, and also significantly reduces the chances of an ATO review or imposition of financial penalties.

3. Client trust of faster service delivery: The clients also benefit from faster reporting, auditing, and reduced delays due to the professional handling of business administration and income tax preparation services, as well as administrative responsibilities. This will build trust and increase the long-term satisfaction of clients.

4. Better operational efficiency: Outsourcing firms have more time to devote to business development and advisory services, rather than performing menial tasks. This freedom of operation improves profitability and quality of service delivery.

Outsourcing enables companies not only to future-proof their operations but also to develop a more agile and service-driven approach to serving their clients.

The ATO regulations, tax lodgment, and SMSF audits are complex procedures that require a very high degree of skill and precision. Leveraging professional SMSF outsourcing services, accounting firms and advisors can confidently resolve the compliance and audit issues of their clients without overwhelming resources.

Outsourcing enables your firm to remain compliant, efficient, and competitive in an evolving regulatory environment, whether through accurate financial reporting, timely SMSF audit services, or comprehensive administration.

Stay ahead of ATO compliance and audit obligations with professional SMSF outsourcing services. Contact us now to discuss how our accounting, administration and audit services can revolutionise your SMSF operations.

At Aone Outsourcing Solutions, we believe smart businesses don’t just manage their accounting; they streamline their accounting process. With years of experience supporting accounting firms and businesses across the UK, USA, Canada, Australia, and Ireland, our team knows how to turn everyday financial processes into strategic advantages.

From bookkeeping and payroll to tax preparation, accounts payable, and compliance, weve helped firms simplify their accounting workflows, cut operational costs, and maintain complete accuracy at every step.

Because at Aone, your accounting success is the goal we care about most.

Content on this website is shared for general awareness and educational purposes only. It should not be taken as financial, accounting, taxation, or legal advice. At Aone Outsourcing Solutions, we do our best to keep all information relevant and accurate; however, we can’t promise that every detail is up to date or fits every business situation. Because regulations and compliance requirements can change, we encourage you to seek guidance from an expert professional before acting on any information on this site. Aone Outsourcing Solutions will not be responsible for any decisions made or losses incurred based on the material published on this website. For advice specific to your business needs, please get in touch with our team .

Special characters are not allowed.