GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

Bookkeeping is one of the most important tasks of running a small business. It is about keeping track of your income and expenses by recording every transaction of your business and maintaining them in a correctly categorised manner. Unlike accounting, which examines the broader financial picture (such as audits, financial analysis, payroll, and accounts receivable), bookkeeping concentrates on the day-to-day financial activities that sustain your business.

For many small business owners, managing daily bookkeeping can feel like a full-time job. Between serving customers, managing staff, and marketing your business, sitting down to organise receipts and track payments often gets pushed aside. But when done incorrectly or inconsistently, it can lead to errors, missed opportunities, and stress come tax time.

That’s where AI bookkeeping tools can be a game-changer. They take the repetitive, manual parts of bookkeeping off your plate, automatically recording transactions, sorting expenses, and updating your books in real-time. These tools work hand-in-hand with your existing accounting software and give you quick insights that help you make smarter decisions, faster. This is how you can automate small business finances with AI efficiently.

As AI becomes more prevalent, leading accounting software platforms, such as QuickBooks and Xero, are already introducing built-in AI features. That means small businesses can now benefit from automation, predictive analytics in finance, and real-time updates without having to switch systems or learn something entirely new. These are perfect examples of cloud-based accounting tools and accounting automation for small businesses.

Now that we’ve covered the basics of bookkeeping, let’s explore what artificial intelligence (AI) actually brings to the table.

When we say AI in accounting, we’re talking about software that can learn how you manage your business finances and then take over routine tasks. It doesn’t mean robots doing your taxes, it means smart tools that handle jobs like sorting receipts, flagging unusual transactions, or predicting when bills will be due. These are the real benefits of AI in bookkeeping.

AI uses something called machine learning, which means it studies patterns in your data. The more you use it, the smarter it gets. Over time, it knows where to categorise your coffee shop purchases, how to match payments with invoices, and when something looks out of place. And it does all this in seconds. This is the power of machine learning in accounting.

AI doesn’t replace your accountant or bookkeeper; instead, it makes their job easier. While your accountant focuses on strategy, tax planning, or compliance, AI handles the repetitive stuff in the background. These AI tools for accountants ensure smart bookkeeping with less effort.

In simple terms, AI tools automate your tedious and time-consuming aspects of bookkeeping and accounting, making them faster, more accurate, and efficient.

Let’s be honest: bookkeeping can be a headache, especially for small business owners juggling a dozen other responsibilities. You want to focus on your products, your customers, your team—but the numbers still need to add up. That’s where AI steps in and turns your stress into simplicity. This is an important driver of digital transformation in finance.

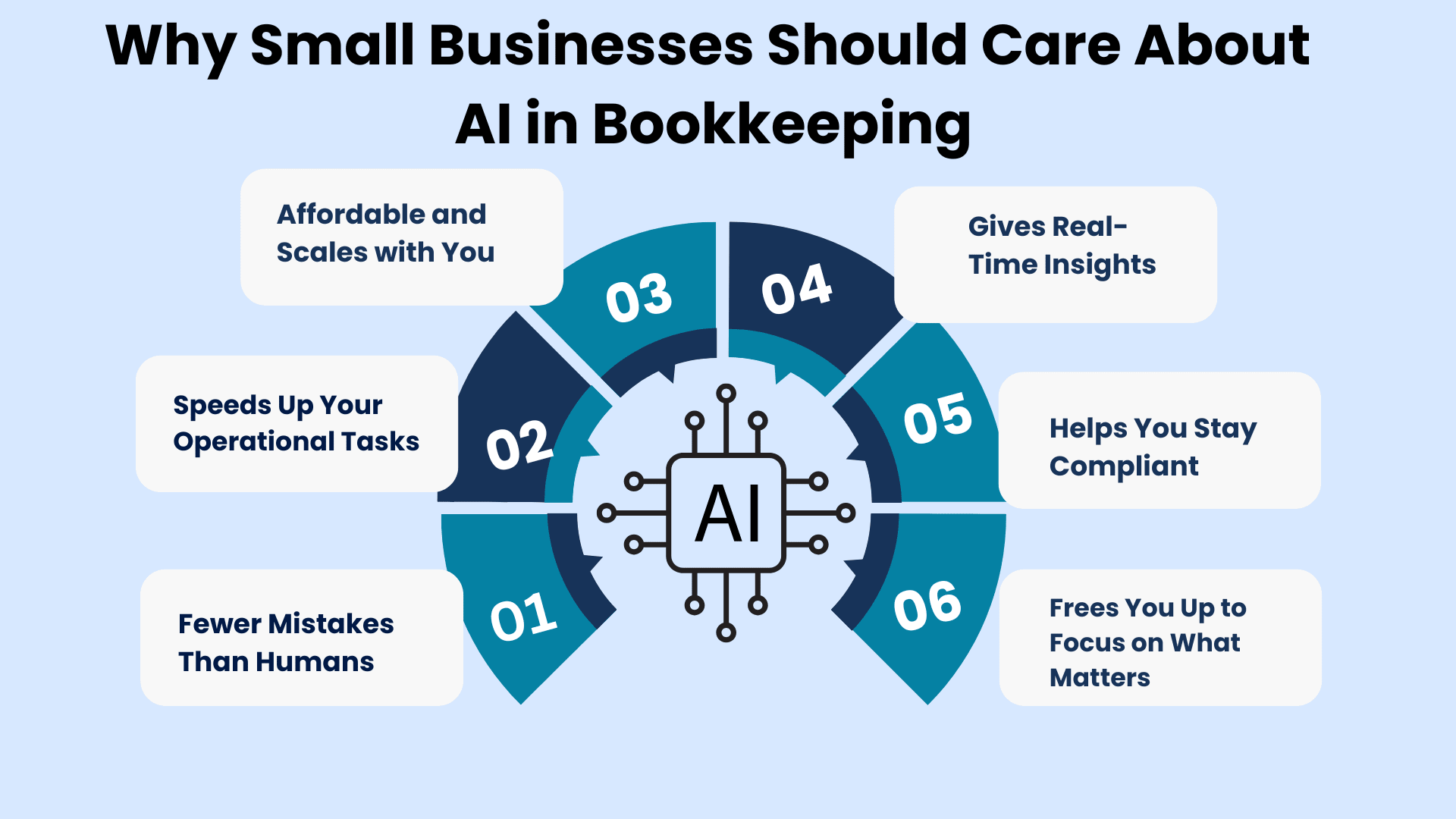

The benefits of AI in bookkeeping are more than just saving time. They help you give you comfort and control over your finances. Here is how AI can seriously improve how you run your business:

Manual data entry is the biggest sources of accounting errors. A number in the wrong column or a missed transaction can throw everything off. AI tools help by automating repetitive tasks with high accuracy. It reads receipts, matches them with transactions, and does it consistently, with no coffee breaks or distractions. AI-powered financial reporting significantly reduces human error.

Reconciling accounts and categorising expenses by hand can take hours. With AI, this happens in seconds. That means month-end closing, reporting, and even daily bookkeeping become faster and smoother. You spend less time fixing books and more time building your business using cloud accounting with AI.

One common myth is that AI tools are expensive. Not true. Many AI accounting software platforms offer entry-level plans perfect for small businesses. Also, they scale as you grow, whether you're a solo freelancer or a growing retail store. These are among the best AI accounting tools for small businesses.

How much did you spend on inventory last week? Can your cash flow handle a big purchase next month? AI gives you data-driven financial insights instantly—no need to wait for a monthly report. You get smarter forecasting, trend analysis, and alerts when something looks off.

It is challenging to stay on top of tax laws and financial regulations can be stressful. AI tools keep you in line by flagging errors, helping with tax categorisation, and ensuring records are audit-ready. It’s like having a watchdog for your compliance an essential feature of AI in financial data security.

By taking over the repetitive stuff like automated expense categorisation, invoice tracking, and payment matching, AI gives you time back. That time can be spent growing your business, connecting with clients, or finally taking a proper lunch break.

In short, AI isn't just a tech trend; it's a business tool that can help you save money, avoid stress, and run your small business more confidently. This is why use AI in accounting and bookkeeping is such a smart move.

If you thought bookkeeping was getting a smart upgrade with AI, wait until you see what it does for accounting. AI is stepping into the accounting world, but it will not replace your accountant. Instead, it saves time, reduces human errors, and makes the entire process more efficient.

Let’s know how everyday scenarios small business owners can relate to:

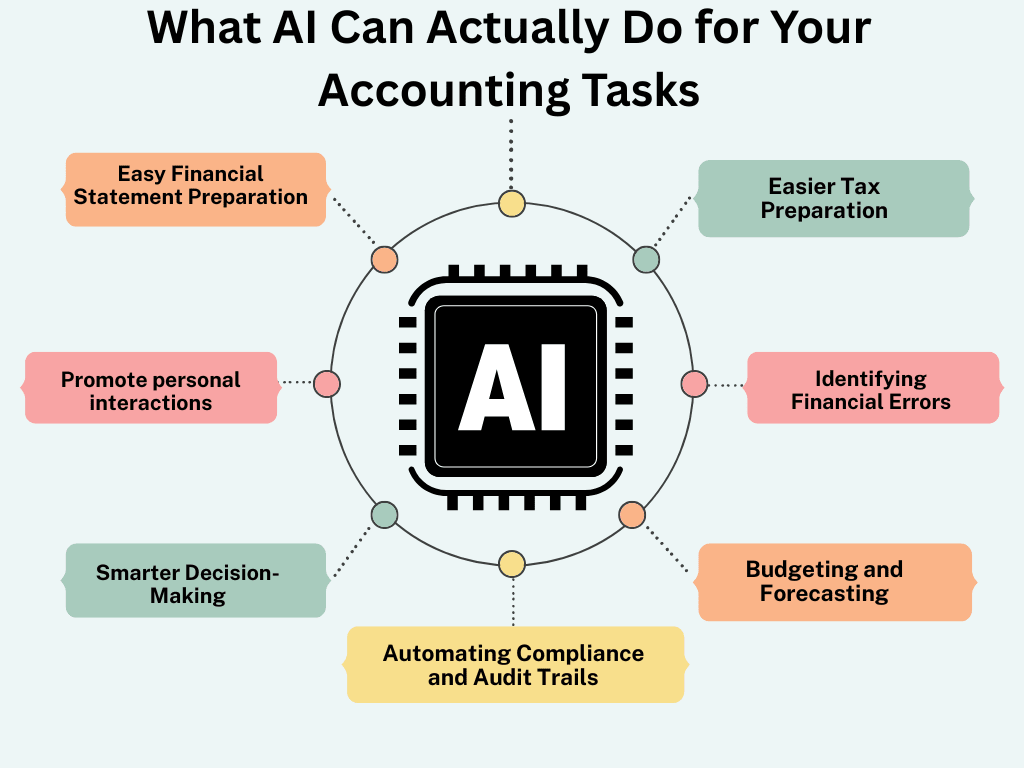

AI-powered tools can pull data from different systems (your bank, POS, invoicing app, etc.) and help generate important financial statements like profit and loss reports, balance sheets, and cash flow statements. No need to fumble through Excel sheets or wait for reports, it’s all generated with the latest numbers at your fingertips.

Ensuring that everything balances, checks add up, transactions reconcile, accounts match and that there is nothing missing in the accounting books is one of the most time-consuming tasks in the accounting department.

The use of AI may speed up the process by highlighting the differences, making proposals on how they can be corrected, even balancing the books using past tendencies and predetermined rules. This is robotic process automation (RPA) in action.

AI doesn’t just crunch numbers, it tells a story with them. Through data analytics and smart dashboards, AI can highlight trends in your sales, cash flow, or expenses and even recommend what to focus on. Think of it as getting a daily financial health report with suggestions, not just numbers.

Tired of the paperwork trail? AI creates a digital paper trail automatically. Every transaction it touches gets logged, categorised, and time-stamped. That means when tax season comes or if you’re audited, you have all your compliance ducks in a row without having to dig through folders or inboxes.

Artificial intelligence instruments use history to develop precise financial prediction. You will have an idea of what will happen with your revenue and expenses and receive recommendations on budget changes to achieve them. That way, it is like having a financial planner in the background, silently computing your route on the latest information.

AI can track the expenditure habits and identify unusual trends, including duplications, overpayment, or a precipitous decline in the amount of free cash. Such an early warning system can help detect problems early on, before they escalate into major issues, allowing you to react accordingly.

7. Easier Tax Preparation

Most modern AI accounting systems already structure your data for easier tax prep, tagging deductible expenses, tracking GST for BAS reporting and ATO compliance and preparing reports that your tax agent can use directly. Some even estimate your tax liabilities throughout the year, so you are never caught off guard.

The truth of the matter is that bookkeeping is no longer the same. The days when we spent hours scrubbing away at spreadsheets or frantically trying to find write-offs during tax time are over. Turning to AI-driven bookkeeping software, small companies now have an opportunity to maintain their books in shape, at the right time, and without a headache. These bookkeeping AI apps, such as Xero and QuickBooks, among others, offer exactly what modern businesses need.

If you are a one-person startup or a small company in the expansion phase seeking to grow intelligently, there is an AI offering that can help you. Whether it is intuitive automation like that offered by Xero or the human-AI hybrid solution of Botkeeper, the right tool will save you a significant amount of time, help avoid costly mistakes, and provide greater transparency into the financial state of your firm.

And don’t forget: embracing AI doesn’t replace your accountant; it gives them (and you) faster, more accurate information.

Frequently Asked Questions

Some of the most popular and reliable AI tools for small business accounting include QuickBooks Online, Xero, Zoho Books, FreshBooks, and Botkeeper. These platforms use AI to simplify everything from data entry to real-time reporting. The best AI tool for your business depends on your specific needs, such as scalability, industry focus, and integration with existing software.

AI drastically reduces human errors in bookkeeping by automating data capture, transaction categorisation, and reconciliation. The key AI bookkeeping benefits include consistent recordkeeping, real-time error detection, smarter financial predictions, and faster month-end close processes, all of which lead to greater financial accuracy and confidence.

AI will not replace accountants, but it will change how they work. While AI excels at automating tasks such as bank reconciliation and invoice management, it often lacks human judgment, strategic thinking, and regulatory expertise. For small businesses, the future isn’t choosing between AI or accountants—it’s using both to get the best of efficiency and expertise.

Keyword: AI in financial data security

Yes, most leading AI accounting platforms are built with strong security features to protect your financial data. These include bank-level encryption, secure cloud backups, role-based access, and compliance with GDPR and SOC 2. If you are concerned about AI in financial data security, stick to well-known providers with a proven security track record.

Keyword: bookkeeping automation tasks

AI can automate a wide range of bookkeeping and accounting tasks, including:

Bank transaction categorisation

Invoice creation and follow-ups

Payroll calculations

Tax form preparation support

Cash flow tracking and forecasting

Receipt and expense capture

These bookkeeping automation tasks save time, reduce stress, and help small businesses focus on growth.

Cost of AI accounting software for small businesses

The cost of AI accounting software for small businesses typically ranges from $20 to $500+ per month, depending on features, user access, and level of automation. Budget-friendly tools like QuickBooks and Zoho Books offer basic AI capabilities, while full-service platforms like Pilot or Botkeeper include human support, which adds to the overall cost.

At Aone Outsourcing Solutions, we believe smart businesses don’t just manage their accounting; they streamline their accounting process. With years of experience supporting accounting firms and businesses across the UK, USA, Canada, Australia, and Ireland, our team knows how to turn everyday financial processes into strategic advantages.

From bookkeeping and payroll to tax preparation, accounts payable, and compliance, weve helped firms simplify their accounting workflows, cut operational costs, and maintain complete accuracy at every step.

Because at Aone, your accounting success is the goal we care about most.

Content on this website is shared for general awareness and educational purposes only. It should not be taken as financial, accounting, taxation, or legal advice. At Aone Outsourcing Solutions, we do our best to keep all information relevant and accurate; however, we can’t promise that every detail is up to date or fits every business situation. Because regulations and compliance requirements can change, we encourage you to seek guidance from an expert professional before acting on any information on this site. Aone Outsourcing Solutions will not be responsible for any decisions made or losses incurred based on the material published on this website. For advice specific to your business needs, please get in touch with our team .

Special characters are not allowed.