GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

The cash flow represents the backbone of any business, and yet it has been a significant source of stress for most Australian firms, especially those of small and medium sizes (SMEs). More than 98% of all businesses in Australia comprise SMEs, and players are major contributors to jobs and the Australian economy.

Nevertheless, a large percentage of these businesses regularly face cash flow difficulties due to late payments, inefficient processes associated with manual processing, and a lack of financial visibility. Delayed payments often hinder cash flow. Australian SMEs experience an average delay of more than 6 days after the due date, and approximately half of the invoices are paid late. In most instances, the delays exceed 30 days, interfering with the payable process and putting a strain on working capital.

Australian businesses lose billions of dollars a year, not only due to lost revenue but also because of the wasted administrative time of their employees. Most owners of SMEs spend more than six hours a week visibly handling invoices, reconciliations, and collections as opposed to working on their growth models.

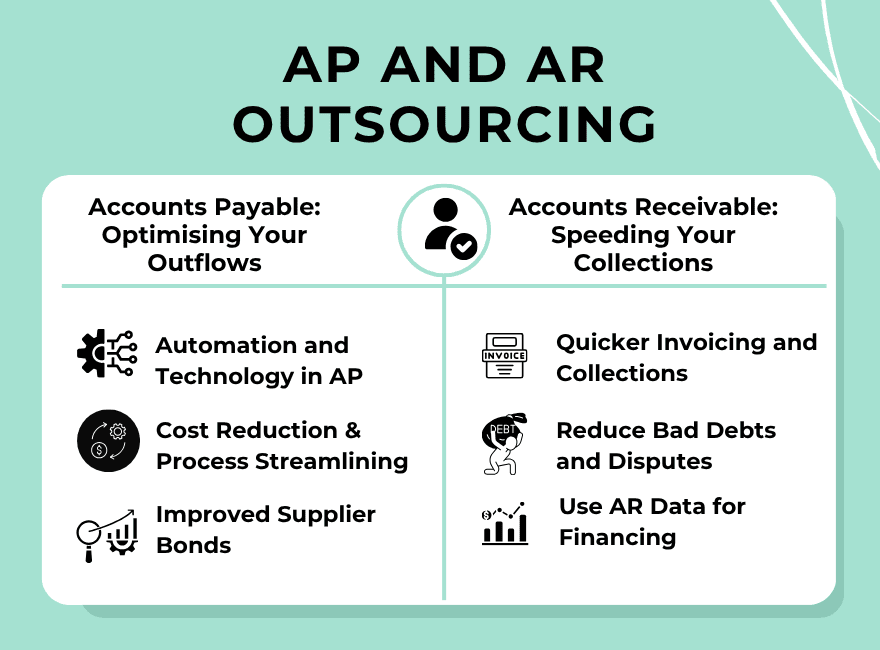

Outsourcing of accounts payable (AP) and accounts receivable (AR) functions has become a prudent and intelligent decision in this complex fiscal environment. Outsourcing to a professional accounts payable company allows SMEs to automate the invoice processes, accelerate collection, and make payments to vendors on time.

Streamlining accounts receivable solutions, improving payable processes, or any other business, outsourcing assists firms in gaining better control over finances and helps the company become risk-averse, while also enabling it to become operationally agile without incurring additional costs.

Ineffective cash flow management continues to be among the leading causes of business failures, particularly among SMEs in Australia. Studies show that most shutdowns in SMEs are caused by a lack of proper liquidity. As soon as inflows are late and outflows are not properly dealt with, businesses have difficulties covering the most important needs, such as paying for drives, rent, and paying off suppliers.

Several entrepreneurs indicate that they have to forgo their wages or freeze recruitments as a result of unpaid receipts. Long payment terms of large corporations (often up to 60, 90, even 120 days) also contribute to the problem. Such a cycle length results in reluctant lending among small businesses that exhaust their resources and creates a credit risk for them.

In response to this, the Australian government has launched the Payment Times Reporting Scheme, which requires that any large firm report how they pay suppliers to small companies promptly. The initial data indicate that a large number of stakeholders have yet to reach the stage of having a 30-day gap, revealing a national picture of a serious problem in the accounts payable management environment.

In such an environment, strong AP and AR operations are not optional but rather mission-critical. Effective accounts payable systems enable prompt and accurate disbursements, foster supplier confidence, and may lead to early payment discounts. In the meantime, accounts receivable as an outsourced service facilitates faster collections, minimizes bad debts, and improves the predictability of cash flows. Here, experienced companies dealing in accounts receivable outsourcing come in very handy.

Additionally, efficient tracking of receivables can enable the business to leverage accounts receivable financing and convert outstanding invoices into working capital immediately. Outsourced AP and AR solutions provide businesses with the visibility and certainty to scale over time, even in uncertain economic conditions, through real-time dashboards, accurate forecasting, and end-to-end automation.

The effectiveness of the payable process is highly crucial in ensuring that there is no loss of liquidity and operational slumps. Nonetheless, a substantial number of Australian companies are still using manual systems, and as a result, they have to pay late, make errors, and incur significant costs to process them. There is a better way: outsource your accounts payable to an established accounts payable business.

Automation and Technology in AP

Modern accounts payable processing automates the activities involved in capturing invoices, routing them for approval, and setting payments. Accounts payable solutions (integrated with any platform without glitches), such as Xero, MYOB, or QuickBooks, optimise tasks by providing real-time visibility and help eliminate data entry errors, increasing processing speed by a significant margin.

Cost Reduction & Process Streamlining

Outsourcing avoids the need for a large AP staff and the expense of software maintenance. You are provided with trained professionals who introduce proven workflows that guarantee compliance, eliminate duplicate payments, and simplify vendor onboarding with reduced administrative overhead, but not at the expense of accuracy.

Improved Supplier Bonds

Regular and prompt payment will increase suppliers' trust in you. A well-structured accounts payable management generates long-term value and a good reputation of being a trustworthy partner, as it eases delays, increases bargaining power, and can bring in early payment discounts.

Equally crucial as you control your outflows, it is essential to increase your inflows. Effective accounts receivables management implies not only efficient collection, but also the non-occurrence or limited occurrence of bad debts, as well as a steady flow of funds. Outsourcing accounts receivable processing provides companies with the necessary resources and expertise to accelerate their revenue growth.

Quicker Invoicing and Collections

Even non-payment sometimes happens due to delays in billing. Outsourced accounts receivable solutions streamline the entire procedure, ensuring that not only are invoices issued promptly, but also that reminders are sent regularly. This reduces the collection cycle and also enhances general cash flow assurance.

Reduce Bad Debts and Disputes

Professionally experienced AR teams make follow-ups and resolve disagreements effectively. That will result in fewer write-offs and overdue accounts. Outsourcing also means that every interaction with the customer is handled carefully, and the relationships a business has with these people are maintained. Still, at the same time, guaranteed payments are secured.

Use AR Data for Financing

With well-kept and accurate records, companies have the option of considering accounts receivable financing to convert unpaid invoices into working capital. This provides SMEs with flexible ways of acquiring funding without assuming traditional debt, making it perfect for addressing seasonal cash shortfalls or injecting growth projects.

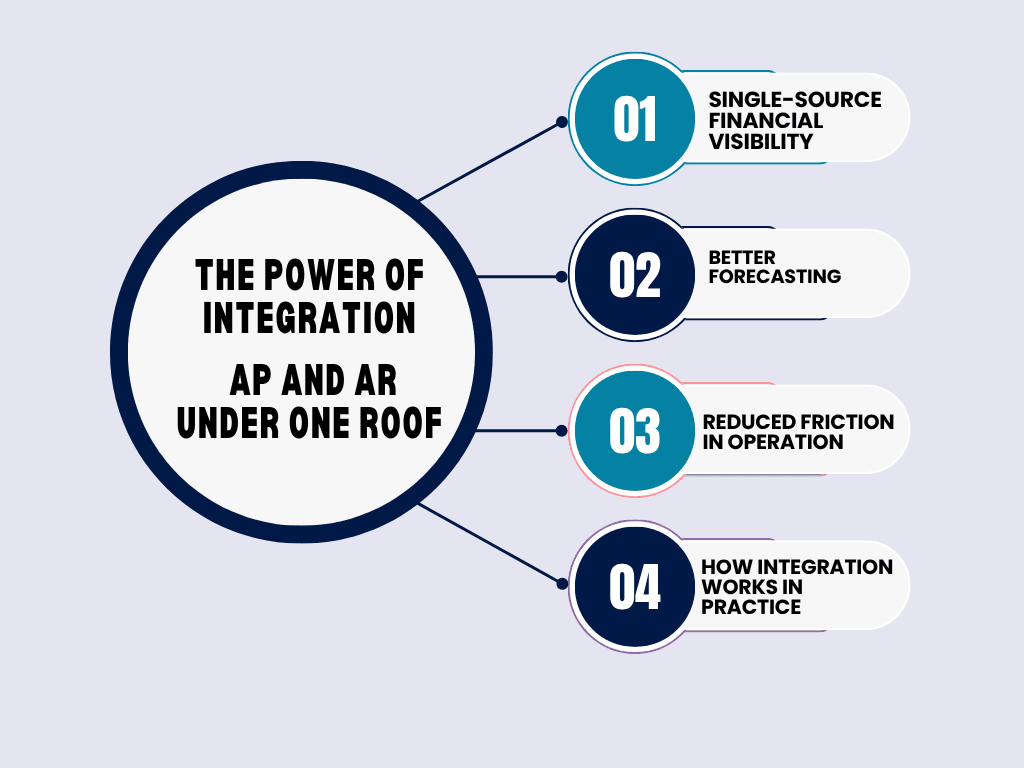

Having accounts payable and accounts receivable processing managed separately, particularly on different teams or systems, can lead to data fragmentation, slow decision-making, and missed opportunities. Outsourcing both AP and AR services to this end can allow Australian businesses to maximise the potential effectiveness of end-to-end cash flow management. In this combined solution, there is a real-time control of inflows and outflows, which allows more intelligent financial management and business development.

When the same entity handles both accounts payable processing and accounts receivable processing, companies benefit from having a comprehensive view of their financial status. Whereas decision-makers need to switch to a different platform or department to see the incoming and outgoing cash, a centralised dashboard allows access to:

Real-time payables and receivables reporting

Clarity of future liabilities and future inflows

An actual image of working capital at any particular period

This real-time and 360-degree financial visibility enhances transparency, accountability, and responsiveness across various departments, particularly for growing SMEs that require tight control over their cash cycles.

When data are not siloed, it is much easier to predict the flow of cash. Combined AP and AR systems will enable businesses to track the timeline for spending and enter the company, which will assist finance departments.

Forecast cash deficiency or excess much earlier

Make investments, buying, or hiring decisions with more confidence.

Do not depend on short-term credit or emergency finance.

When the accounts receivable solutions are in line with accounts payable solutions, financial planning is planning and not reacting, and the Australian companies may feel secure in making decisions that are aimed at their growth.

Management of several service providers or internal departments can cause communication dislocations, duplications, and delays. These inefficiencies are removed by outsourcing AP and AR to a single trusted partner. The outcome is:

Less handoff across teams.

Standard approvals, collections, and reporting processes

Automated work patterns that lower administrative costs

Not only does this decrease in friction save both time and money, but it also decreases the likelihood of late fees, compliance issues, and damaged vendor and customer relationships.

Consider the following situation: One of the medium-sized retail companies in Melbourne has two outsourcing partners. The system automatically keeps a record of the expected receivables each time a new invoice is posed to a customer. At the same time, the future payments to vendors are reported and programmed in the same system.

At this point, a finance manager who goes to the dashboard can immediately tell that in the next 14 days of operation, 45000 dollars will be due to the company, and at the same time, 30000 dollars should be received by the company as payment for one of the customers. With this understanding, the manager will choose to delay a non-emergency payment to a supplier by a week and save on overdrafts. No emails, no guesswork- simply informed real-time decisions.

In short, the combination of accounts payable and accounts receivable management handled by a single outsourcer brings quantifiable benefits: real-time visibility, enhanced accuracy, quicker determination, and minimised manual care. To the Australian business wishing to expand with confidence and stability, this total solution is no longer an option; it is a necessity.

In terms of managing your cash flow with assurance, Aone Outsourcing is a reputable accounts payable company that has been performing in the Australian market for a long time. Our team is familiar with the special needs of the regulation, taxes, and compliance services that exist in Australia that govern AP and AR processes, making your business very compliant with the Australian financial requirements.

We fully integrate with many other popular accounting systems, such as Xero, MYOB, and QuickBooks, so that all transactions can happen in real-time with a transparent overview of your financial systems. Our tech-enabled services are the right solution to the agility and precision needed by a growing SME or an existing enterprise.

The most outstanding part about Aone is that we will provide you with tailored workflows that suit your business uniquely. Whether issuing invoices or communicating with clients, we will tailor our services to your internal controls and reporting requirements according to your strategy. Having extensive experience in the industry for more than five years, we can help businesses of all sizes succeed with trusted, end-to-end AP and AR outsourcing.

Outsourcing of accounts payable and accounts receivable is no longer a cost-cutting strategy, but a strategic gain, which boosts efficiencies, cash flow, and long-term growth. The list of benefits is obvious: from automated invoicing and payment scheduling to more intelligent forecasting and better vendor and client relationships.

Aone Outsourcing offers Australian companies the ability to deal with a complete service provider which has expert knowledge of the local market, takes advantage of the latest financial technologies, and works out custom solutions. We combine the cash flow control in your hands with the elimination of tedious manual work and compliance risk.

Are you ready to take charge of your cash flow?

Allow Aone Outsourcing to simplify your AP and AR processes professionally and accurately.

Call us now and get a free consultation to learn how we can make your business grow with confidence.

Outsourcing activities such as accounts payable processing and accounts receivable can enable organisations to automate processes, decrease errors driven by manual entry, and gain expertise by outsourcing. This results in quick processing, increased compliance, and cash flow visibility.

Yes. Outsourcing has the capacity of up to 25 percent or even more improvement of business operational efficiency as per industry standards. This is done by making the process of payable fast, increasing the accuracy of invoices, as well as speeding up the collection, particularly when the AP and the AR are managed by the same provider.

Outsourcing accounts receivable is a practice that entails contracting a third-party business to perform duties such as invoicing, collections, credit management, and debt development. Both of the outsourced accounts receivable solutions are effective in reducing the amount of overdue accounts and increasing cash collection with no additional burden to the internal department.

Outsourcing does away with multiple staffing inside an organisation to do the same and slashes administrative burdens and costs, and offers access to scalable accounts payable processing and automation. This not only pushes down the price but also increases the speed of processing, creating an overall greater efficiency.

Absolutely. When one outsources the activity to an entity specialising in accounts payable, there is no need to invest in infrastructure, and the related costs are not exposed to the risk of non-compliance and training expenses. The effect is a lighter, faster-footed operation that saves cost yet enhances financial control.

At Aone Outsourcing Solutions, we believe smart businesses don’t just manage their accounting; they streamline their accounting process. With years of experience supporting accounting firms and businesses across the UK, USA, Canada, Australia, and Ireland, our team knows how to turn everyday financial processes into strategic advantages.

From bookkeeping and payroll to tax preparation, accounts payable, and compliance, weve helped firms simplify their accounting workflows, cut operational costs, and maintain complete accuracy at every step.

Because at Aone, your accounting success is the goal we care about most.

Content on this website is shared for general awareness and educational purposes only. It should not be taken as financial, accounting, taxation, or legal advice. At Aone Outsourcing Solutions, we do our best to keep all information relevant and accurate; however, we can’t promise that every detail is up to date or fits every business situation. Because regulations and compliance requirements can change, we encourage you to seek guidance from an expert professional before acting on any information on this site. Aone Outsourcing Solutions will not be responsible for any decisions made or losses incurred based on the material published on this website. For advice specific to your business needs, please get in touch with our team .

Special characters are not allowed.